The 2023 holiday season was something of a watershed moment for the mobile commerce segment. Shopping on phones has been around since roughly 1997, albeit in a very different format. Back then, consumers were really only able to use their phones to buy things like ringtones and music. Today, not a day goes by where we whip out our phones and participate in some act of the shopper journey.

It wasn’t until last year, though, that mobile shopping – m-commerce, as some call it – was the preferred method of purchase during the holiday shopping season (November-December). According to data from a recent Adobe Analytics report, 51 percent of holiday season sales in 2023 were driven by mobile devices. That figure, Adobe predicts, will rise slightly to 53 percent in 2024.

The rise in m-commerce adoption, Adobe says, is due to a number of factors including increased consumer demand for speed and convenience in the shopper journey along with retailers improved mobile shopping experiences.

While the headline of Adobe’s report puts the attention on the upcoming holiday season, there’s more to the m-commerce market than just the final two months of the year. In fact, the Adobe report shows just how much mobile shopping has become an important category for retailers, no matter their size and no matter the product they sell. And other industry research helps to support why this is an avenue that cannot be ignored.

With that in mind, here’s a look at four more important data points on mobile commerce.

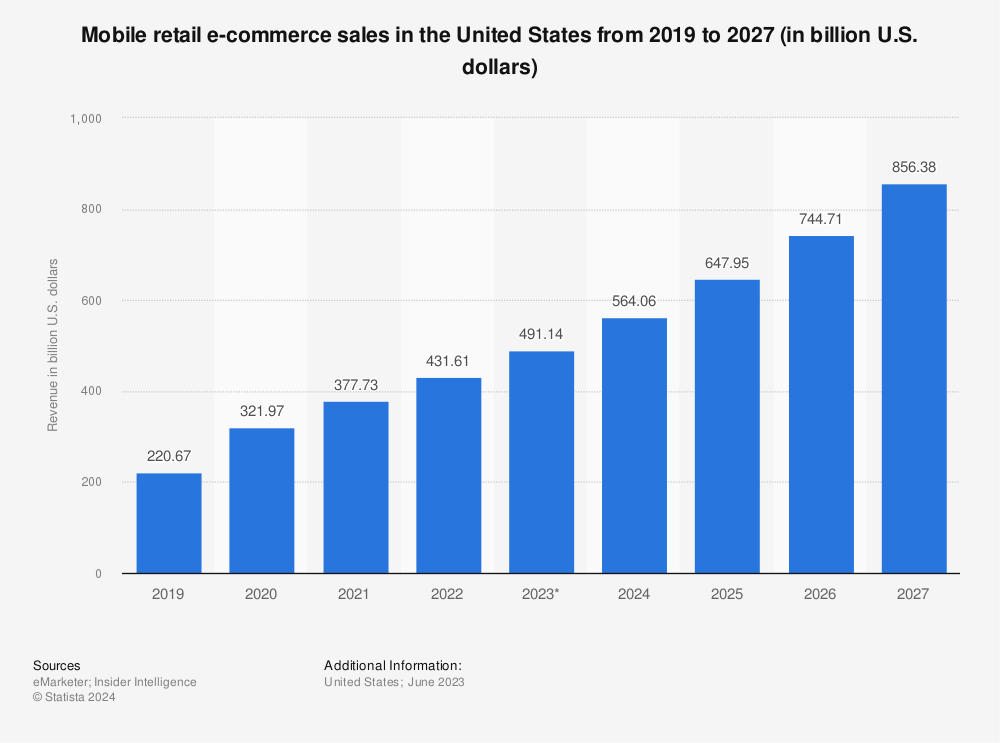

Mobile Commerce Revenue Will Double by 2027

In 2023, U.S. consumers spent roughly $491 billion on purchases made via their mobile devices, according to a report from Insider Intelligence. That was already nearly double what consumers spent in 2019. Forecasting ahead, total spend through m-commerce could total around $856.4 billion by 2027.

Looking at this spending segment from an annual growth perspective, the massive jump in 2020 is pretty self-explanatory. People were home; they shopped on their mobile devise. Even with the “trail off” in year-over-year growth from 2021 on, the m-commerce segment could still see around 15 percent annual growth over the next four years.

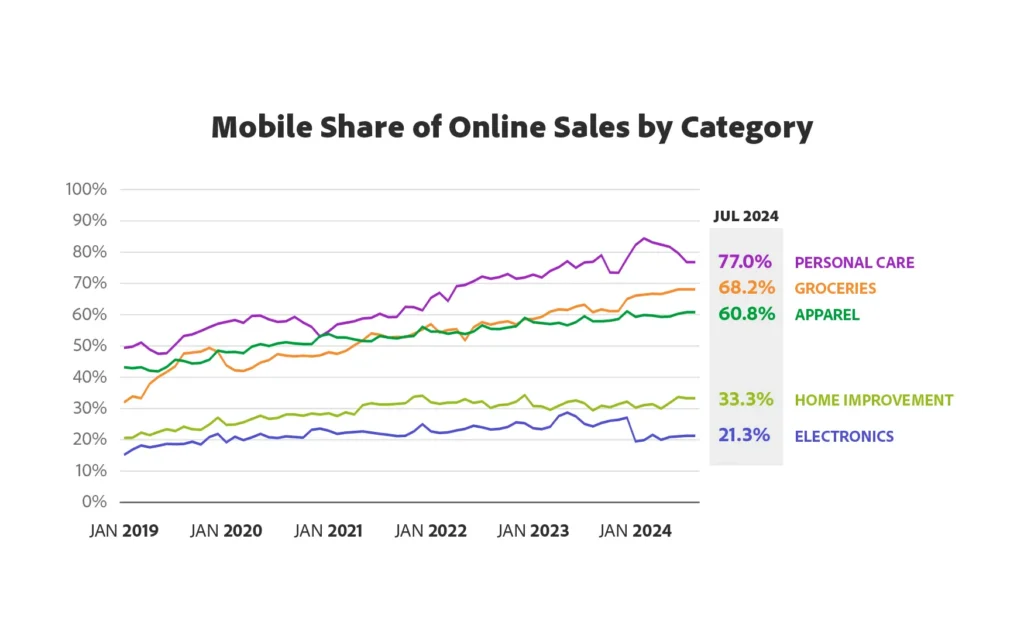

Big-Ticket Items See Growing Mobile Share

There’s no denying that m-commerce spend is dominated by smaller items in more fluid categories. Adobe’s report shows that mobile groceries sales in July 2024, for example, made up 68.2 percent of the total online spend. And it remains one of the dominant categories in that regard, alongside personal care products and apparel.

Still, those bigger ticket items are seeing growth in this area. In 2019, the home improvement and electronics categories saw their mobile share at around 20 percent and 15 percent, respectively. Fast forward to July 2024, those numbers increased to 33.3 percent and 21.3 percent. So, they’re growing, and there’s still plenty of potential in those areas.

“We expect larger purchase will begin to shift towards smaller screens as well,” Vivek Pandya, lead analyst for Adobe Digital Insights, said of the report. “Adobe’s data also shows that basket sizes on mobile are 32 percent smaller than on desktop, which presents both a challenge and opportunity for brands to refine mobile experiences and close the gap to drive revenue.”

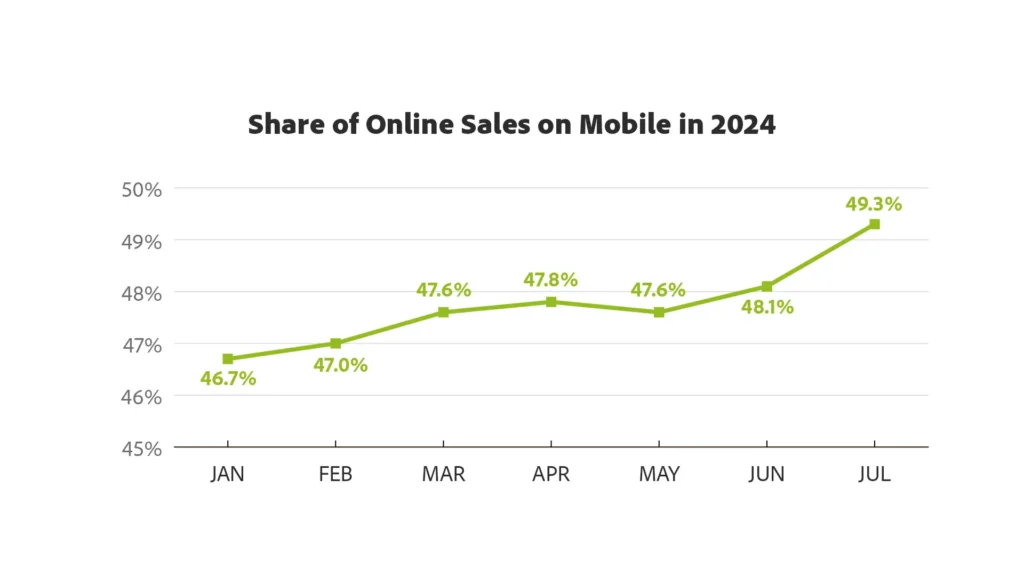

Mobile Will Make Up Nearly Half of Online Sales in ’24

Mobile sales have been on a very strong path through the first half-plus of 2024. According to Adobe Analytics, mobile sales have accounted for at least 46.7 percent of all online sales in the U.S. through the first seven months of the year, and that figure has only gone up, month-over-month since January.

The 49.3 percent share realized in July 2024 netted a record $280.4 billion spent through mobile devices that month, which represented 10.2 percent year-over-year growth. Of course, promotional events like Prime Day and 4th of July sales helped with that. But it shows that consumers are not only becoming more comfortable with the concept of buying product online and on their phones – they actually prefer it.

“Small Retailers” Seeing Growth in Mobile Sales

Looked at from a size perspective, it’s probably no shock that larger retailers (those with an annual revenue of $1 billion or more) see more of their customers shift towards making purchases on smaller screens. Mobile sales account for 52.8 percent of online sales (monthly average, according to Adobe Analytics) for these retailers. That’s compared to 43 percent (monthly average) for smaller retailers (those with annual revenue between $10 million and $100 million).

Granted, we know that these “smaller” retailers – i.e. independent businesses – generally pride themselves on the in-store experience and giving customers a reason to get off the couch and into their showrooms. That doesn’t mean you need to leave money on the table by neglecting the mobile shopping experience altogether. There’s certainly an opportunity for you and your business to look at the mobile market as a revenue driver – even for these big-ticket items. A customer likely won’t impulse buy a washer/dryer combo, but when one of their laundry units breaks down, they most likely will start that search with the smart device that’s closest to them.