The statement in and of itself seems rather counterintuitive but hear us out. A recent report from CBRE – a research firm specializing in commercial real estate – details how both physical and online retail have fared in the years since the pandemic and how both continue to play an integral role in the overall success of the industry.

To make sense of that initial statement, it’s important to take it piece by piece and understand how the retail industry – much like corporate America – has evolved from a purely in-person (or in-office) experience to one that’s hybrid in nature. And that’s the exact picture that the CBRE report attempts to paint.

Foot Traffic Recovering

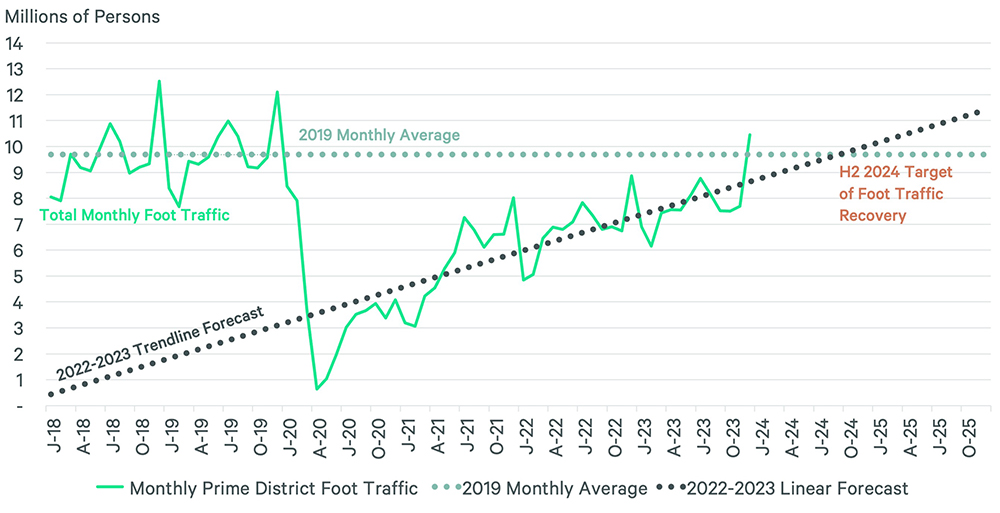

At a high level, what the CBRE found is that consumers are nearly back to their 2019 pre-pandemic levels of in-person shopping. According to the report, average monthly foot traffic in a number of prime retail districts that CBRE tracks had recovered to around 81 percent of those pre-pandemic highs. CBRE said it anticipates a full recovery will happen around Q3 of this year, and consumers could ultimately surpass those previous levels by the end of 2025.

Source: CBRE

What’s interesting though, as the report notes, is that many retailers have said their sales have already surpassed pre-pandemic levels, despite the fact that foot traffic hasn’t fully returned. CBRE suggests that this trend might be explained by the Pareto Principle – better known as the 80-20 rule. That rule posits that 80 percent of consequences come from 20 percent of causes (the “vital few”). So, when applied to retail, the rule would state that 80 percent of all sales come from 20 percent of consumers.

And, to that end, the CBRE report concludes that retailers – particularly those that serve high-end markets – are catering to their best customers by leaning into things like loyalty programs and “private club” experiences and offers.

Physical Stores are Driving Digital Sales

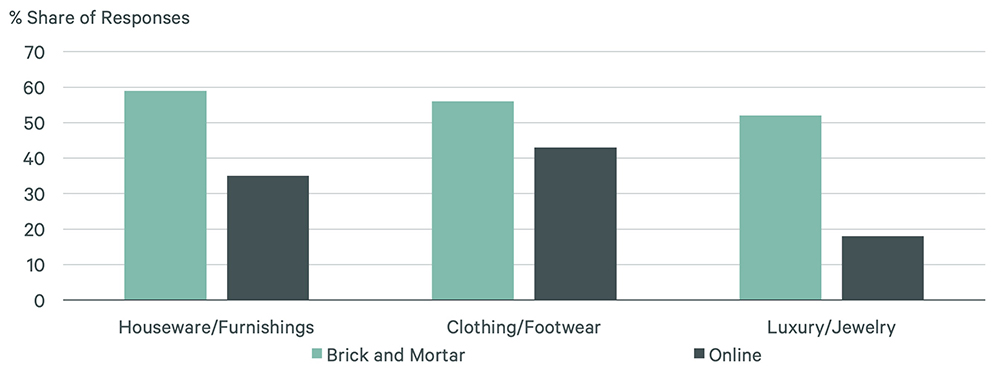

Even as consumers continue to make the move off their couch and back to brick-and-mortar retail, there’s plenty of evidence to suggest retailers need to maintain and even up the level of investment in their digital presence. For starters, while the in-store experience is preferred across the board no matter the type of retailer, there is a growing interest among consumers to do their shopping online. That’s just the reality we live in in this post-pandemic world.

Source: CBRE

What’s more, data from a recent International Council of Shopping Centers report shows just how big of an impact the opening or closing of a physical store has on online sales. When a physical store opens, ICSC found that digital sales for an established brand jumped nearly 7 percent. Conversely, a store closing saw those digital sales drop off by more than 11 percent.

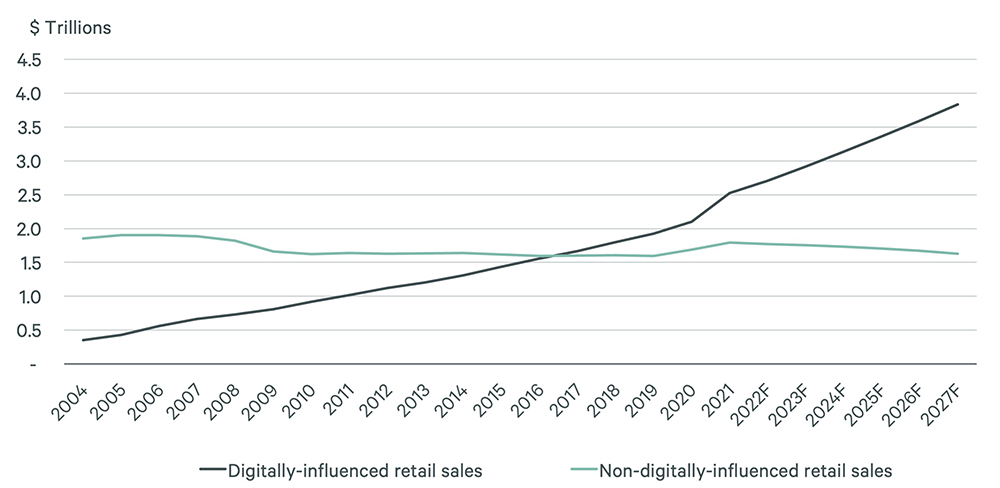

We already know that consumers favor a digital-first approach in their shopping journey, with some 90 percent of shoppers researching product online before making a purchase. In further support of the importance of a strong digital presence, the CBRE report shows that digitally-influenced retail sales have been on the rise over the past two decades. By 2027, nearly $4 trillion in retail business will be digitally influenced, compared to roughly $1.5 trillion for non-digitally-influenced retail sales.

Source: CBRE

CBRE also dove into the topic of showrooming – the act of going in-store to view a product before making the purchase online. According to the report, 56 percent of the consumers they surveyed said they like to see an item in-store before buying online. That data falls in line with a recent report from Consumer Insights Now that dove into consumers’ furniture shopping habits. There, CIN found that 44 percent of the consumers they surveyed admitted to going into a physical furniture store to look at and test a product before making the purchase online. The two main reasons for opting to buy online were price and free shipping.

Additionally, CBRE found that physical stores continue to play a critical role in the hybrid shopping experience. When it comes to making a return, over half (54 percent) of online shoppers prefer to return items in-person. And nearly a third (31 percent) of online shoppers said they prefer picking up online orders in-person. Both scenarios create an opportunity for brick-and-mortar businesses to positively impact the customer experience. With in-person returns, there’s the chance to capture an alternative sale or provide an in-person experience that helps to retain the customer long-term. And with in-store pickup, there’s the chance to keep that customer in the store longer and make additional purchases, or, similar to the return experience, the retailer can provide a smooth and seamless order pickup experience that results in improved customer loyalty.

Ultimately, what we learn from all of these different reports and data points is that in-store and online shopping are no longer – and, truthfully, haven’t been for some time – mutually exclusive from one another. The successful retailer today is one that’s able to effectively blend their physical and digital presence and leverage them both to create an unforgettable customer experience.