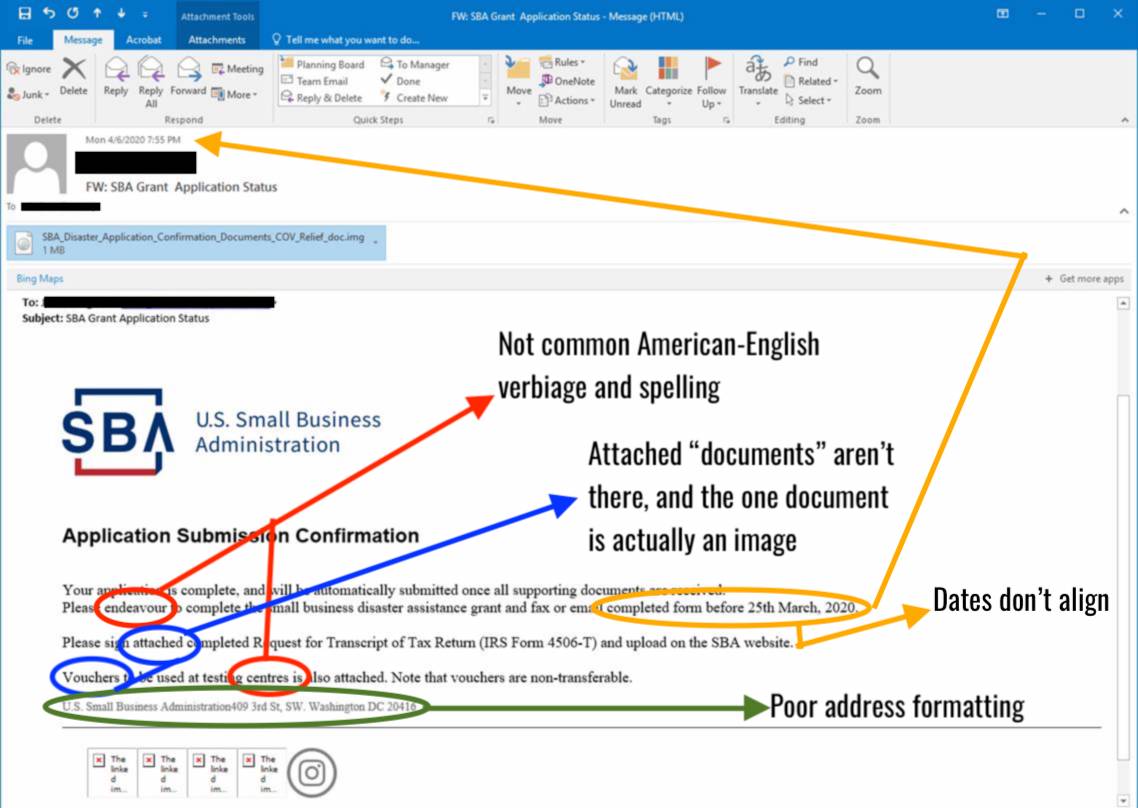

With small businesses financially vulnerable right now — and as the U.S. Small Business Administration is sorting its way through applications for the Paycheck Protection Program — the time is ripe for scam artists and email phishing attacks to start hitting business owners’ inboxes. Nationwide members have alerted us to a number of these instances, and we wanted to bring it to your attention. Below is an example of an email sent to a retailer, purporting to be from the SBA. But look a little closer, and notice some of the inconsistencies and other signs that clearly point to this being a fake. Scroll down a little further and you’ll see our “solution” to this riddle.

Before jumping into the emails themselves, here are a couple of good rules of thumb should you find one of these in your inbox:

- DO NOT, under any circumstances, click on any links or download any attachments in the email

- Do not provide sensitive personal information (like usernames and passwords) over email. Ever.

- Mark the email as spam or junk to increase the likelihood that it is filtered out of your inbox in the future

- Delete the email

- Report the email to a supervisor, a superior, or — in this instance — pass it along to the SBA so they are aware of the phishing attempt

- If the sender is listed as a colleague or coworker, notify them of the attempt

- Some email clients (Outlook, Gmail, Apple) will allow you to report the phishing attempt to them directly so they can flag the sender

Now, on to the fun stuff.

What’s Wrong With This Picture?

Let Us Show You…