CARES Act Webinar

On March 31st, Nationwide hosted a webinar featuring employment attorneys discussing the impact of the Families First Coronavirus Response Act and the recently-passed CARES Act. Download the slide deck for this webinar right here.

Exactly 10 days after signing into law “Phase 2” of the Coronavirus relief efforts, President Donald Trump put ink to paper, making official the largest single economic stimulus package in U.S. history. “Phase 3,” the CARES Act, is a $2 trillion relief bill that will touch nearly every part of the U.S. economy.

Where H.R.6201 (a.k.a. Phase 2, a.k.a. the Families First Coronavirus Response Act) focused on employees’ rights and providing paid sick leave and expanded FMLA rights for workers impacted by the virus, S.3548 (a.k.a. Phase 3, a.k.a. the CARES Act) is geared towards putting dollars in the pockets of individuals and businesses in order to prop up a very shaky and fragile economy. The bill is projected to provide nearly three-times as much financial assistance and relief as the American Recovery and Reinvestment Act of 2009.

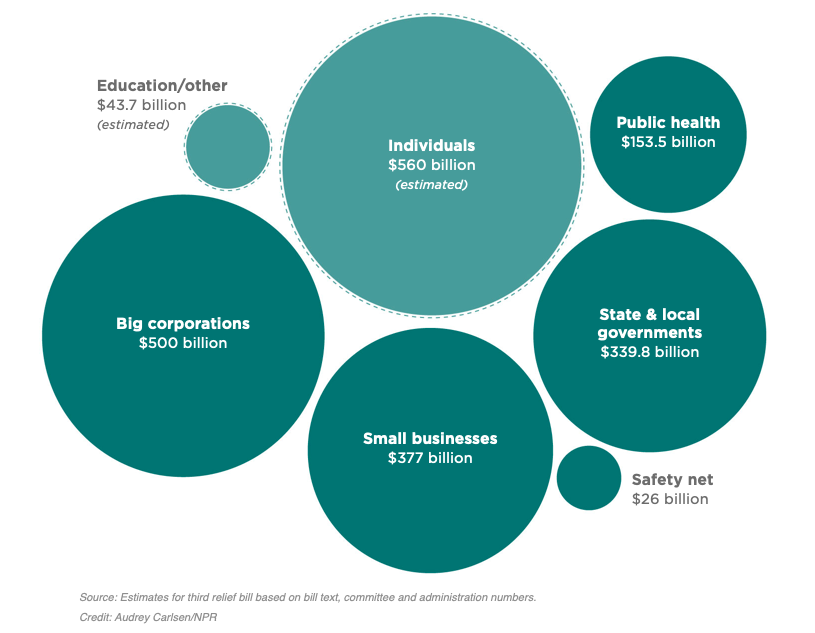

But how does the $2 trillion shake out, and what benefits and impacts will the CARES Act have for small businesses? This simple graph, created by NPR, paints a great picture of just that:

First and foremost, the bill sets aside an estimated $560 billion for individuals. That includes the cash payments that will be distributed to most working Americans. According to the text of the bill, most individuals making $75,000 or less can expect a one-time payment of $1,200. Married couples would each receive a check, as well as a $500 credit per child. Checks would start to reduce in value and eventually phase out for people making more than $99,000 (couples making more than $198,000).

For Small Businesses

The CARES Act reserves some $377 billion for small business relief, including emergency grants and forgivable loan programs for companies with fewer than 500 employees. Additionally, the bill includes changes to rules for expenses and deductions that are intended to make it easier for companies to keep employees on their payroll and stay open in the near-term.

That $377 billion is broken down like this, per the NPR report:

- $10 billion is earmarked for emergency grants of up to $10,000 for small businesses to cover immediate operating costs.

- The Small Business Administration will have access to $350 billion to provide loans of up to $10 million per business. Any portion of that loan that is used to maintain payroll, keep workers on the books or pay for rent, mortgage and existing debt could be entirely forgiven if workers stay employed through the end of June.

- The remaining $17 billion is set aside to cover six months of payments for small businesses already using SBA loans.

Additional segments of the bill cover large corporations, state and local governments, the public health sector and education. There’s also a $26 billion safety net included in the bill that will provide things like funding for schools to continue providing meals for students, food stamp coverage and funding for food banks and other community food distribution programs.