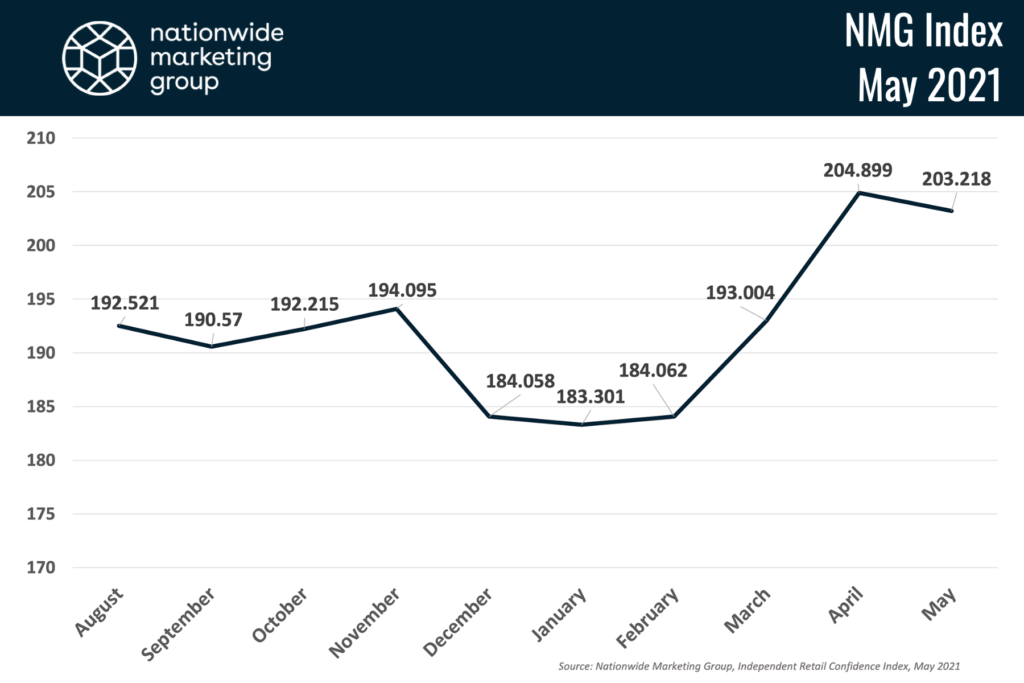

Coming off of an all-time high month, the Nationwide Marketing Group Independent Retail Confidence Index had a tall assignment, trying to carry that momentum forward. Did the strong wave of confidence carry the NMG Index even higher into May? No. But that said, the Independent retail channel’s confidence remained relatively flat this month, and still recorded the second-highest confidence total in the survey’s brief 10-month history.

Heading into May, Independent retailers reported an overall confidence score of 203.218, down from that all-time-high of 204.899 in April. On the percentage scale, the NMG Index checked in at 72.32% for May, down 0.6% month-over-month.

Retailers reported a number of reasons for the continued strong wave of confidence. Among them, increased inoculations across the country is resulting in increased foot traffic in retailers’ stores. They may not have fully-stocked warehouses while the supply chain continues to catch up, but consumers are out shopping — and they seem to be scooping up whatever they can get their hands on.

But how long will that last?

“I believe demand is going to normalize to pre-COVID levels or lower due to the end of the stimulus and the reopening of other sectors of the economy such as travel, entertainment and dining,” one retailer said. “As this happens people will have more choices on where to spend their disposable income. I feel in my market, and the northeast in general people want to resume these activity with zeal. People are tired of being in their homes, so they will walk out of their house, shut the door and not return until fall — metaphorically speaking.”

Given the current state of the supply chain, though, a small downtick in demand could help manufacturers start to catch up before we get to the holiday shopping season (which is already just a few short months away — somehow….).

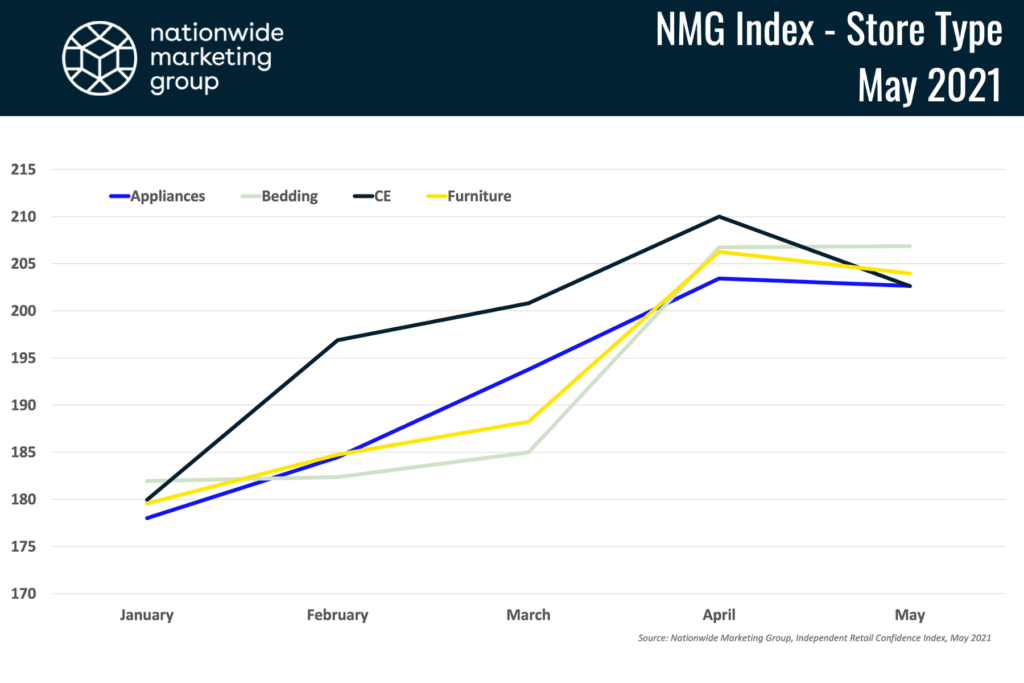

On the store-type front, all categories remained strong heading into May.

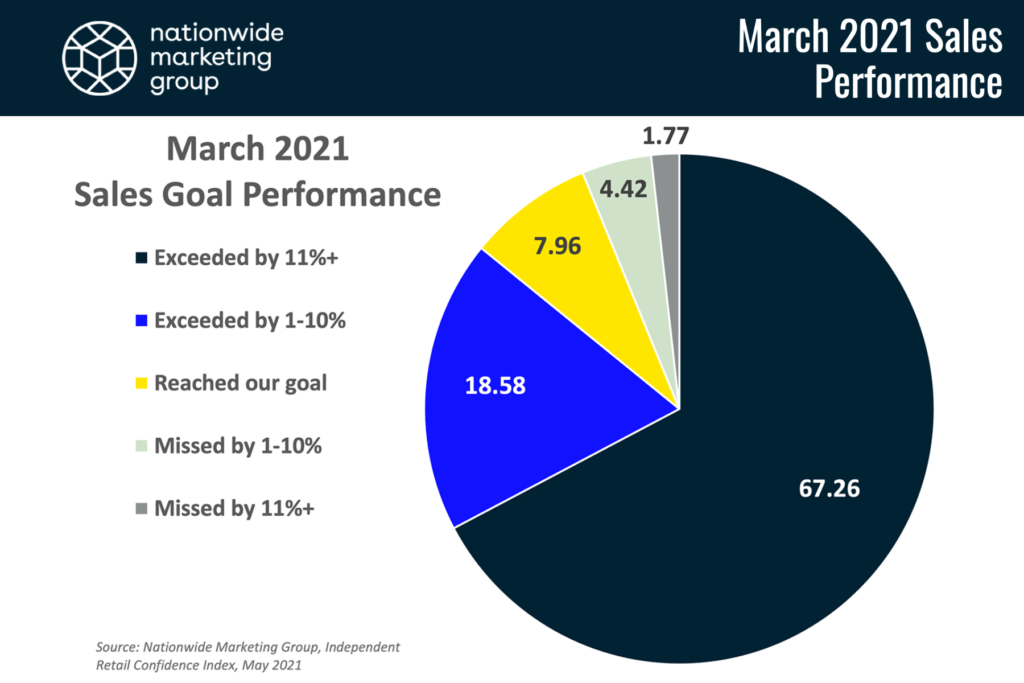

Sales Goal Performance Surges

There wasn’t a ton of movement, month-over-month across the various aspects of the NMG Index, with the exception of one area in particular — sales goal performance. Looking back at the March NMG Index (the first chart up above), you notice that that’s the month our survey started it’s dramatic turnaround that resulted in two straight months of skyrocketing confidence.

Now, with the March sales goal performance results available to us, we get a better understanding as to why retailers started down that path.

In March, 67.26% of retailers exceeded their sales goal by 11% or more. That’s the highest figure that we’ve recorded in our NMG Index survey. Another 18.58% exceeded their sales goals by 1-10%. The combined 85.8% of members who exceeded their sales goal in some form was the highest total since the first edition of the NMG Index survey last August when the 85.7% did the same.

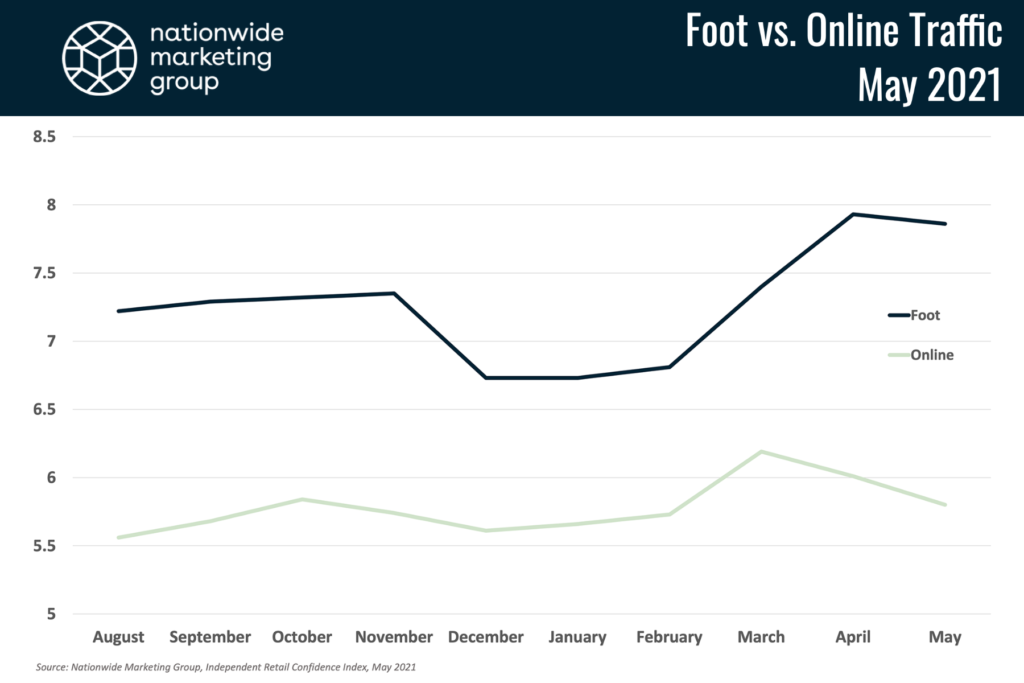

Foot Traffic vs. Online Traffic

The gap between the two forms of traffic got a little wider in May. Foot traffic confidence continued to outpace its digital counterpart, opening up a 2-point “lead” heading into May.

Looking at the trend line for Foot Traffic confidence in the NMG Index, it almost directly correlates with the path of the survey’s overall confidence score. It dipped ever-so-slightly this month, down less than a tenth of a point, but still was the second-highest total on record.

As with the overall survey score, retailers point to the increased number of vaccinations and consumers’ intent to put boots to the pavement/retail floor as the reasons for their strong foot traffic confidence level.

On the online side of things, retailers who operate websites report strong traffic to their digital presences. However, conversion appears to be happening in store. Again, the desire to get outside of the home is the main driver of the drop off in confidence here.

“Online sales has slowed since early spring,” said one retailer. “I think people are now feeling very good about coming into the stores.”

Product Confidence Maintains Solid Levels

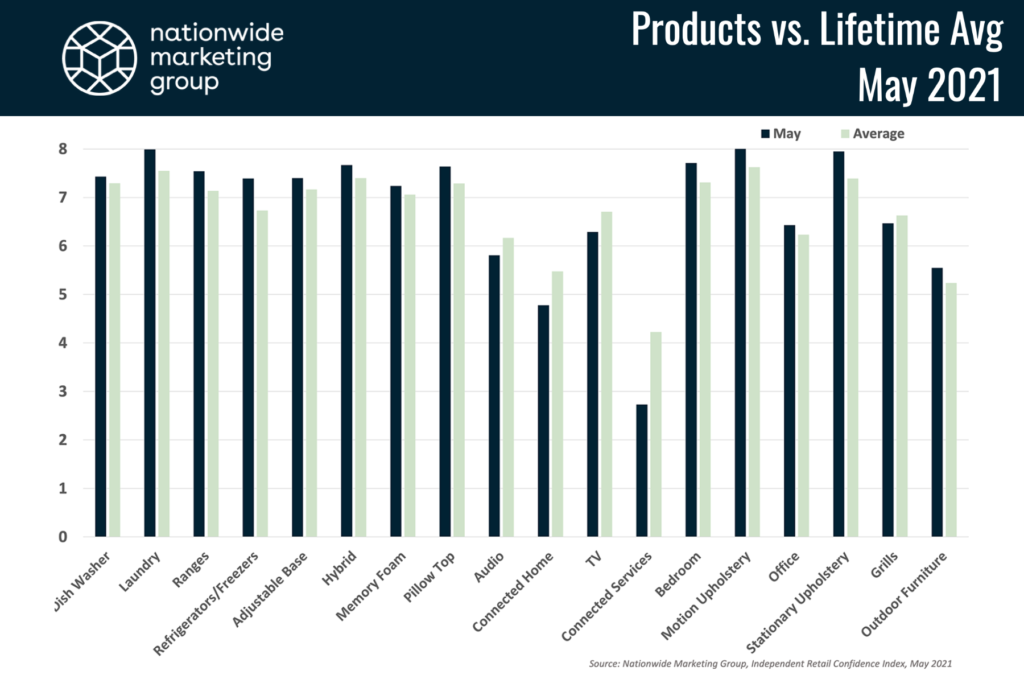

As a whole, the 18 product categories surveyed for in the NMG Index recorded a monthly average score of 6.78 (out of 10), which was slightly above the lifetime average score of 6.70. Only five products checked in with scores lower than their lifetime averages.

Interestingly, four of the five products were from the Consumer Electronics category. We can only speculate as to why this was the case, but as our recent coverage on the NMG Blog suggests, the ongoing chipset shortage, which has hampered the CE supply chain, could be to blame there. CE products have generally fared well in the NMG Index, which is why it’s likely May could end up being an outlier in this regard.

Elsewhere, Motion Upholstery, one of the strongest performing categories in the NMG Index, moved back into the top spot for the first time since January with its 8.02 score this month — tied for the highest single-month score for any product since this survey began.