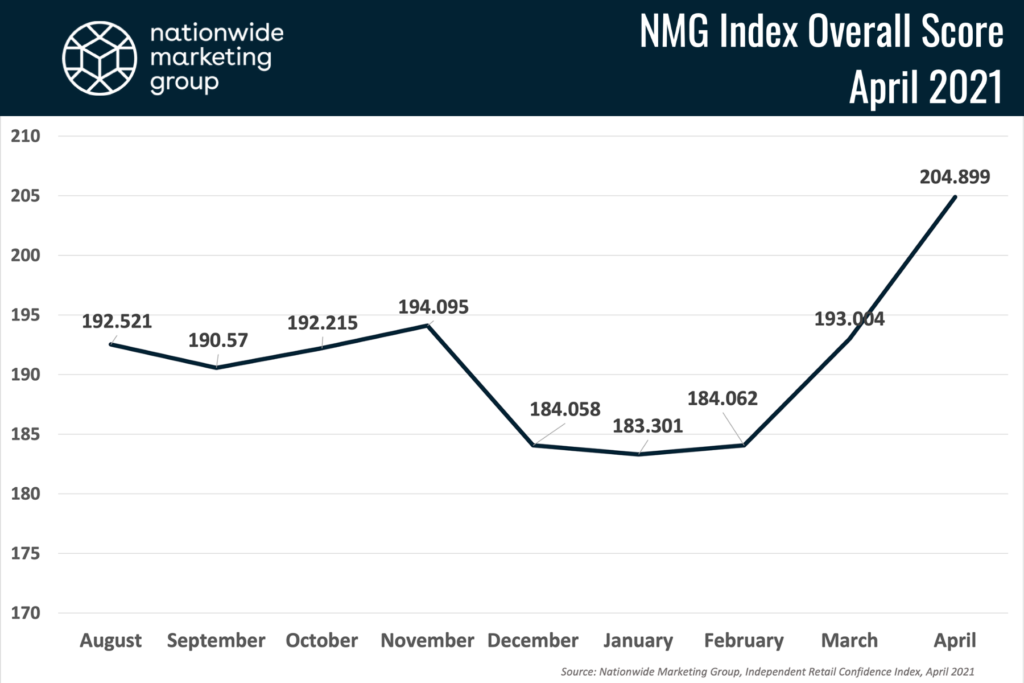

For the second month in a row, Independent retailers reported a strong confidence increase. The nearly 12-point jump in confidence heading into April was record-setting in a number of ways for Nationwide Marketing Group’s Independent Retail Confidence Index. First, it was the single-largest month-over-month gain in the nine months of the report. And second, it sent the NMG Index to an overall score of 204.899, the highest level recorded to date.

On the percentage scale, the NMG Index checked in at 72.92% in April. This month marked the first time the report tipped above 70%, and it was the largest month-over-month gain in the survey’s history, moving up 4.24% over the March survey.

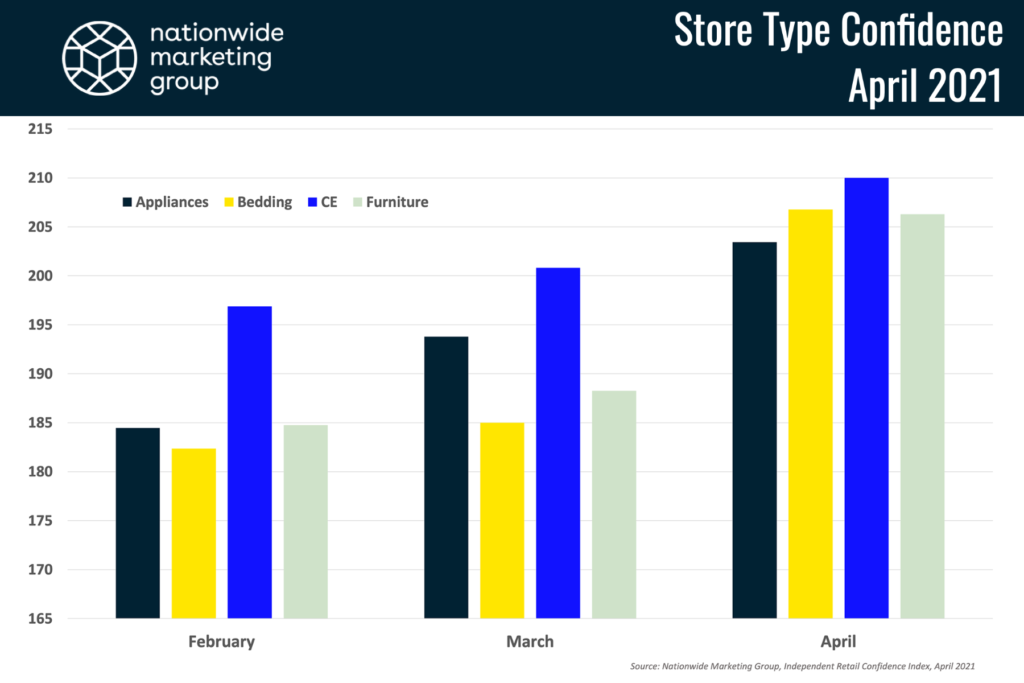

From a store-type perspective, April was a record month across the board. All categories were up over the 200-point threshold, led by Consumer Electronics, which checked in at 210. Previously, only CE stores had reached the 200-point mark having done so twice — back in October and in March.

Digging through the numbers of the survey helps to paint a clearer picture of how Independent retailers’ confidence jumped so high, which we’ll get into. But reading through their responses to the survey, many of the same reasons were given as to why confidence continues to increase at a rapid rate. Namely, retailers continue to see strong consumer demand for appliances, furniture, bedding, and consumer tech products. That, coupled with increased cashflow due to stimulus checks and tax returns, and Independent retailers are seeing consumers use that cash to invest in major in-home upgrades.

“Our sales have been accelerating for the past several months with each new month being a record month,” one retailer reported.

Another said, “Tax season is upon us, stimulus is out there, but the wild card continues to be the lack of product getting into retailers’ stores.”

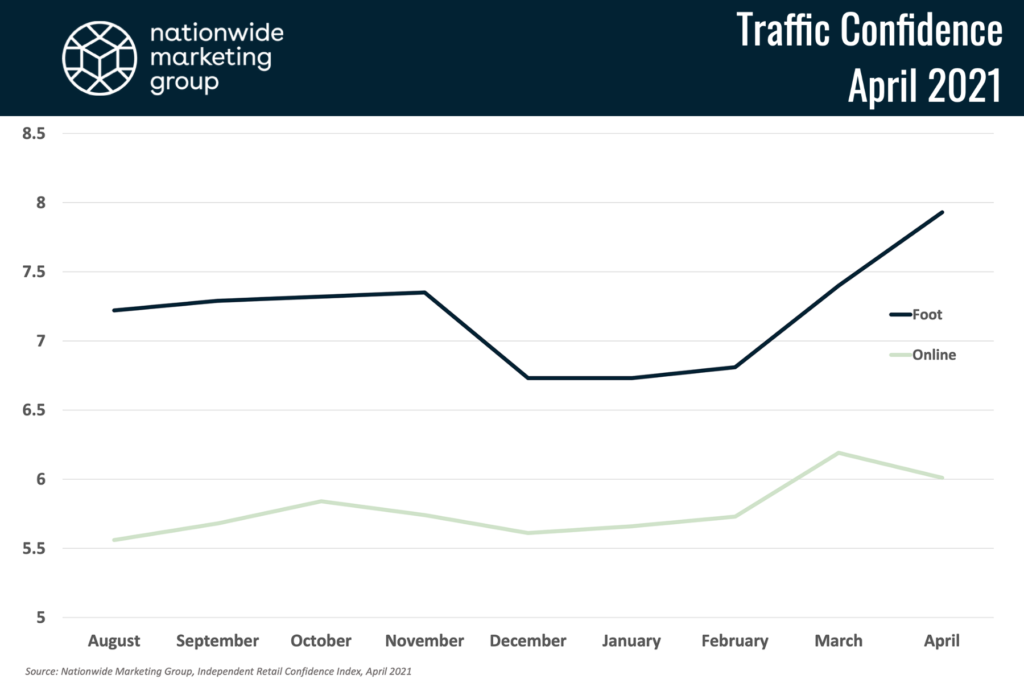

Consumer Traffic Confidence Pushes Up

Retailers reported strong overall confidence gains in April. But there was also a major spike north in their confidence that foot traffic will be strong this month.

Retailers attributed that increase almost exclusively to the increasing number of Americans who’ve been vaccinated. Recent data show that 3 million COVID-19 vaccines are being administered on average each day, with some 4.1 million being administered over the Easter weekend.

“Vaccinations should continue to encourage customers to shop in person vs online like the past year,” one retailer said.

In addition, a number of retailers reported that keeping their foot on the advertising gas pedal has aided their ability to drive traffic to their store. “Our foot traffic has been higher than normal,” they said. “We have continued to advertise and customers seem to be finding us easier than ever.”

On the online side, retailer confidence dropped slightly, mostly due to the continued struggles with the supply chain. To that end, retailers that are having success online report that added features around product availability have helped consumers find them and spend with them. “We have an ‘in stock’ feature on our website that has become popular for people looking for things quickly,” one retailer said.

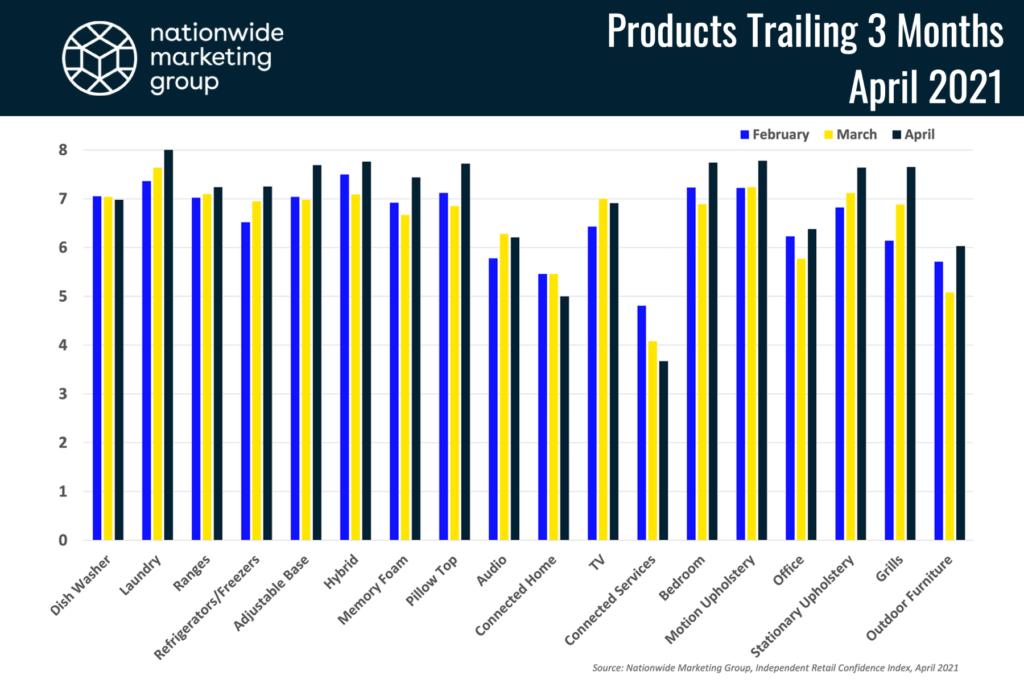

Big Boost for Products

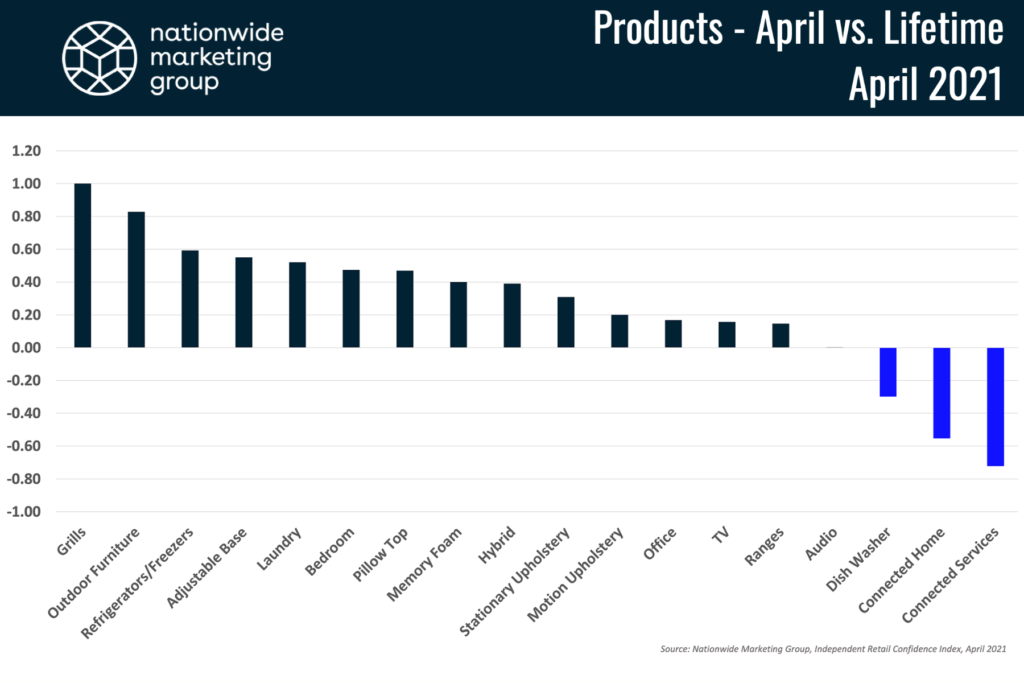

Each of the product categories surveyed for in the NMG Index had a strong April as well. The average score for the month was up nearly half a point to 6.95. That number was also up a quarter of a point over the lifetime average score for products (6.69). For April, only three of the 18 products surveyed for scored lower than their lifetime average, and only four products failed to produce a higher month-over-month score.

Furniture, Bedding and Outdoor in particular had strong months with every single product in those categories outperforming the previous month and their lifetime averages.

Consumer Electronics products seem to struggle, looking at the collective survey results. But if you drill down into just the CE dealers specifically, those confidence numbers improve by nearly a full point per product, based on what you see in the chart above.

Sales Remain Strong

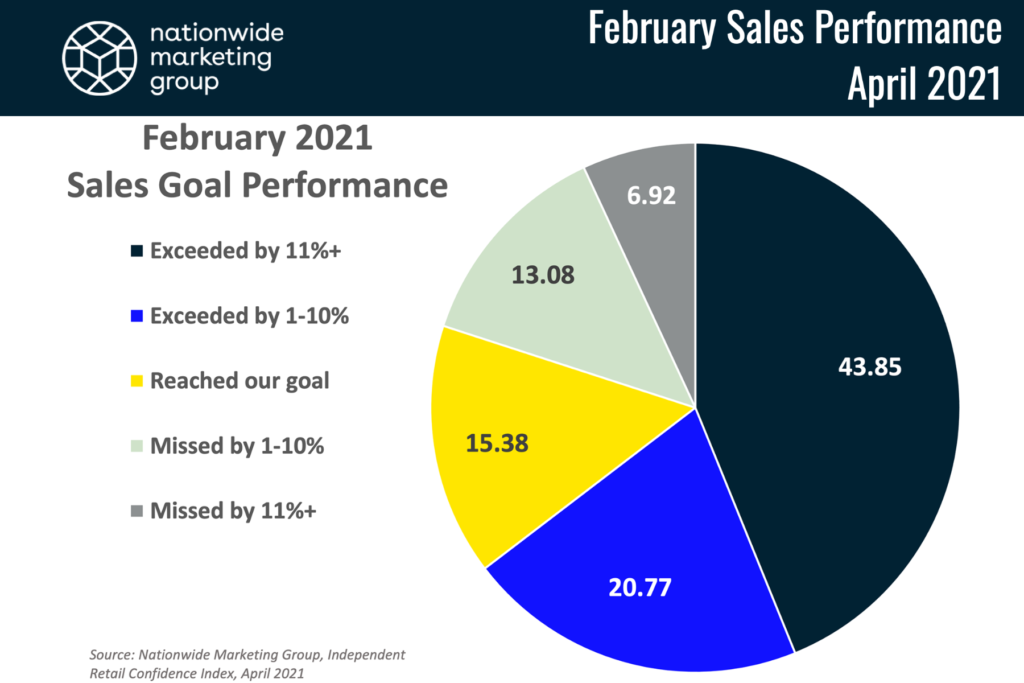

Retailers reported another strong month of performance against their sales goals for February. The early months of 2021 have been solid, according to retailers who responded to the NMG Index.

For February, more than 64% of retailers reported exceeding their sales goals, which was down slightly from 69% in January. Collectively, 80% of retailers either met or exceeded their goals for February.