September is an all around busy month in general with Labor Day vacations happening, the school year starting back up, Fall creeping closer and football — both college and professional — kicking off their respective seasons. The impact of all of that activity on the independent retail channel’s confidence level? A slight dip heading into the month.

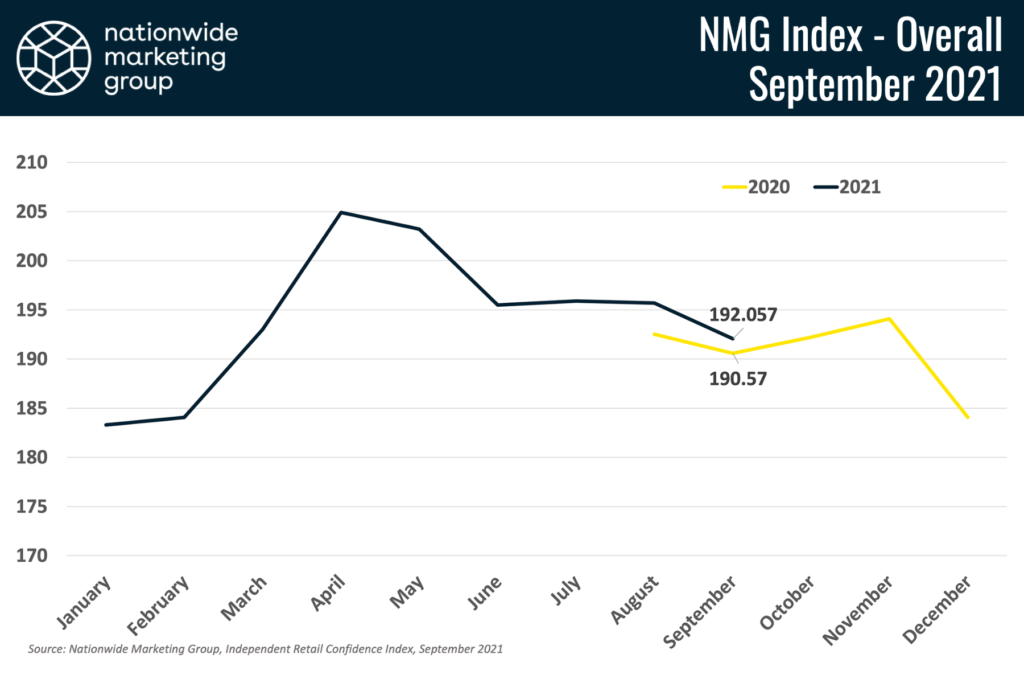

According to the latest Nationwide Marketing Group Independent Retail Confidence Index survey, dealers saw their month over month confidence score drop a little more than 3.5 points to 192.057 for September (down 1.29 points to 68.35% on the percentage scale). On a year-over-year basis, the NMG Index continues to track higher in 2021 than it did in 2020. September ’21 checked in roughly 1.5 points higher than this month last year.

Despite the dip, plenty of retailers surveyed this month suggested that business remains strong.

“The fourth quarter is typically our strongest quarter and we are at record pace for the year, so I expect that to continue, as long as we can get product,” said one retailer. Another added, “People need appliances. The box stores are failing them so they are looking for quality dealers who can actually provide solutions.”

When diving deeper into the factors that drive uncertainty among independent dealers, the list looks all too familiar. For starters, the rise in COVID-19 cases related to the Delta variant has had an impact on both foot traffic and spending, according to a number of retailers. Additionally — and certainly related to the ongoing pandemic — supply chain constraints continue to be a concern.

“We have a customer base that wants to buy,” said one retailer. “The biggest problem is the supply. I feel that our people have the ability to get the right products to the people despite the lack of availability.”

Supply challenges coupled with material shortages and increased shipping costs have also resulted in product price increases — another concern highlighted by retailers this month.

“We’ve seen a steep increase in pricing, and not only in home furnishings,” one retailer said. “This has led to less store traffic and customers not willing to spend.”

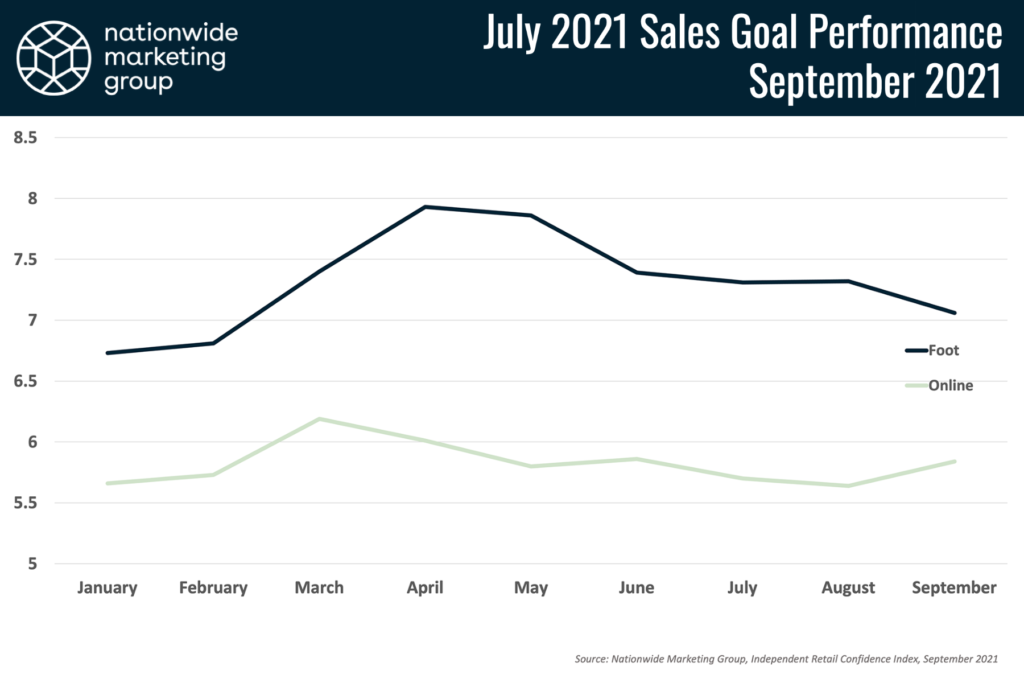

As expected with the dip in overall confidence, and the concerns highlighted by retailers in the report, foot traffic confidence fell off in September. The 7.06 score for foot traffic this month (on a scale of 1 to 10, with 10 being most confident) was the lowest score since retailers recorded a 6.81 in February. Conversely, and perhaps driven by the fact that more consumers will be shopping from home as COVID cases climb, online confidence saw its largest month-over-month increase since March of this year.

Product Perform Strong YoY

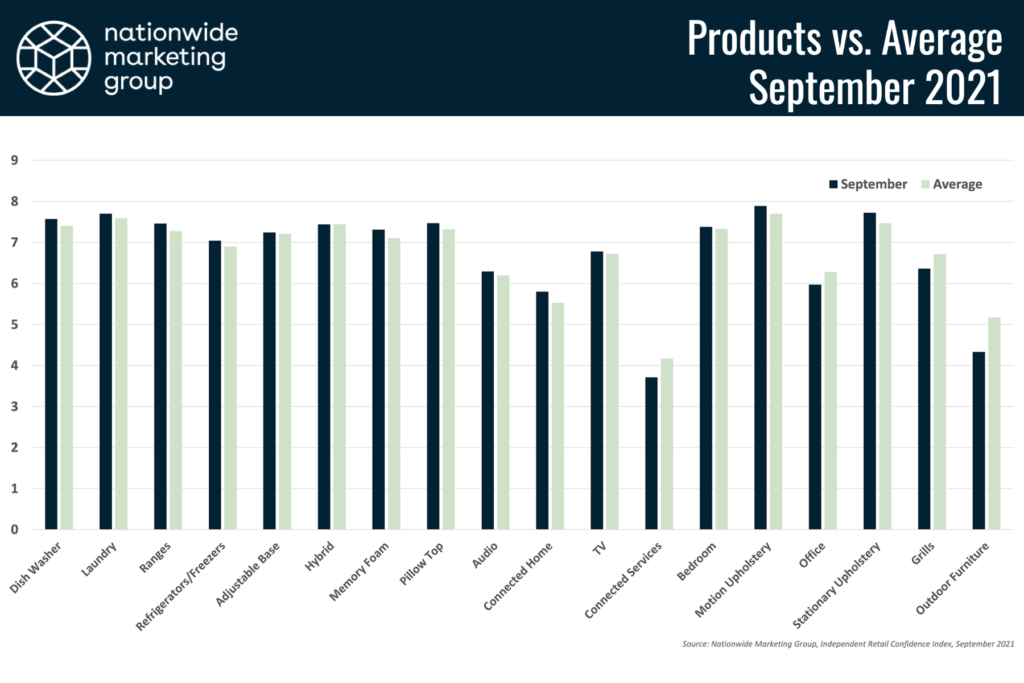

Independent retailers had a relatively average month across the 18 product categories that the NMG Index surveys for. In fact, the average score of 6.75 across all categories in September matched the 6.75 lifetime average for all products.

Month-over-month performance was down with only 6 categories saw confidence score increases from August to September. However, looked at on the year-over-year plane, September was a strong month.

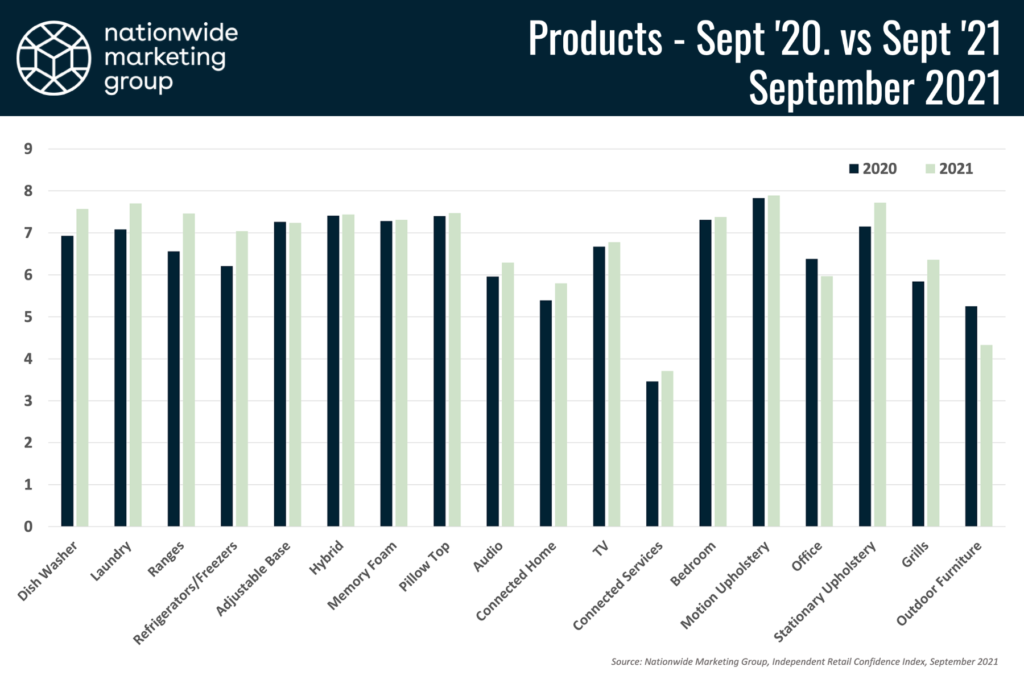

In total, 15 of the 18 product categories scored better in September 2021 than they did a year ago. The only categories to see a dip were Adjustable Base (down 0.02 points), Office Furniture (down 0.41 points) and Outdoor Furniture (down 0.92 points).

The decline Office Furniture is an interesting one for September, given the heightened awareness around back-to-college purchases and students needing desks and other product. But the decline could point to retailers’ struggle to get office inventory rather than their lack of confidence in being able to move the product — if they had it.

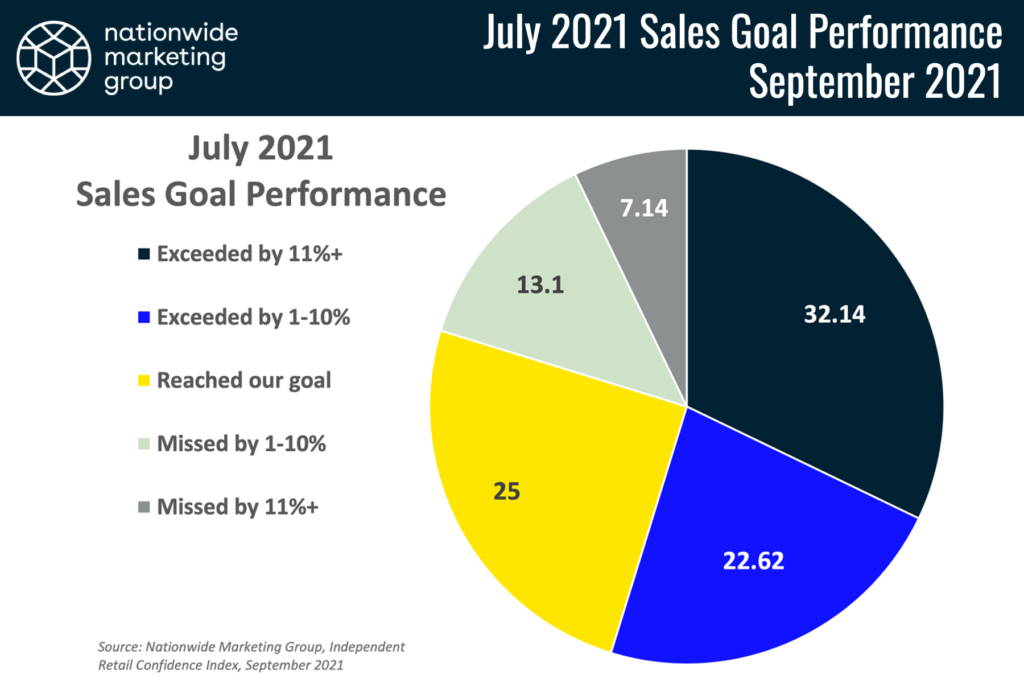

July Sales Still Strong

Independent retailers had another strong month of sales goal performance in July. According to responses to the latest NMG Index, roughly 80% of dealers met or exceeded their sales goals for that month.

Specifically, 32% exceeded their goals by more than 11%, another 23% exceeded their goal by between 1 and 10%, and another 25% hit their sales goal on the mark.

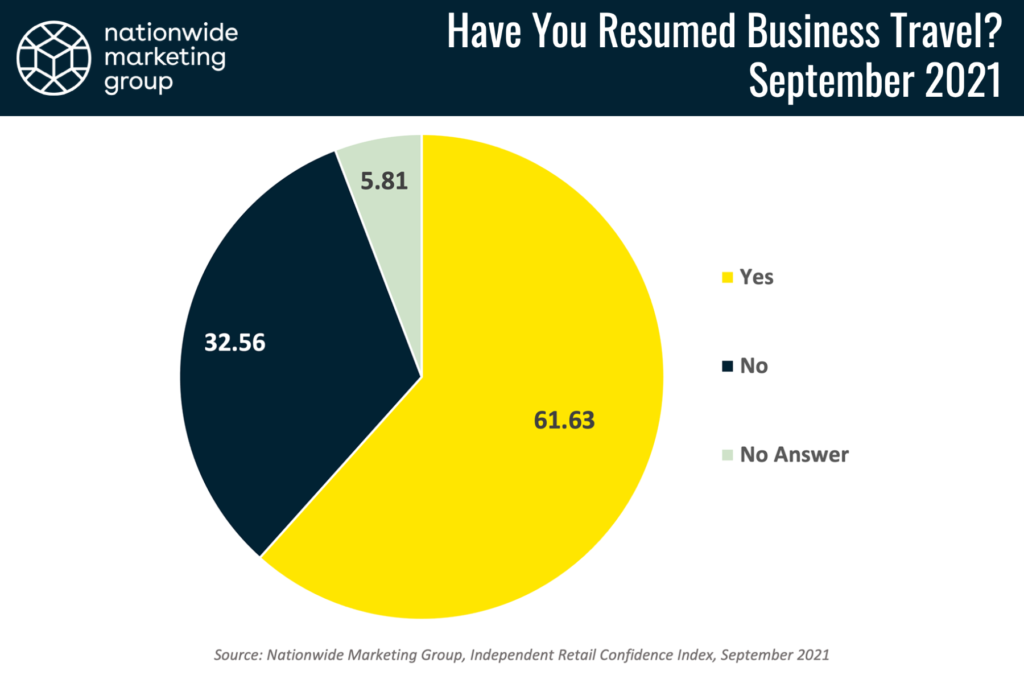

Business Travel Picks Back Up

This month, in partnership with Dealerscope, we asked independent retailers whether they planned to (or had already) started to hit the road for business travel or to attend industry-related events. Here’s what we found.

While slightly more than 61% of dealers said they would (or had) travel for business, a solid one-third of retailers are still holding off on getting back out on the road. That number shows that, similar to retailers’ waning foot traffic confidence this month, they themselves are still not quite ready to travel for business.