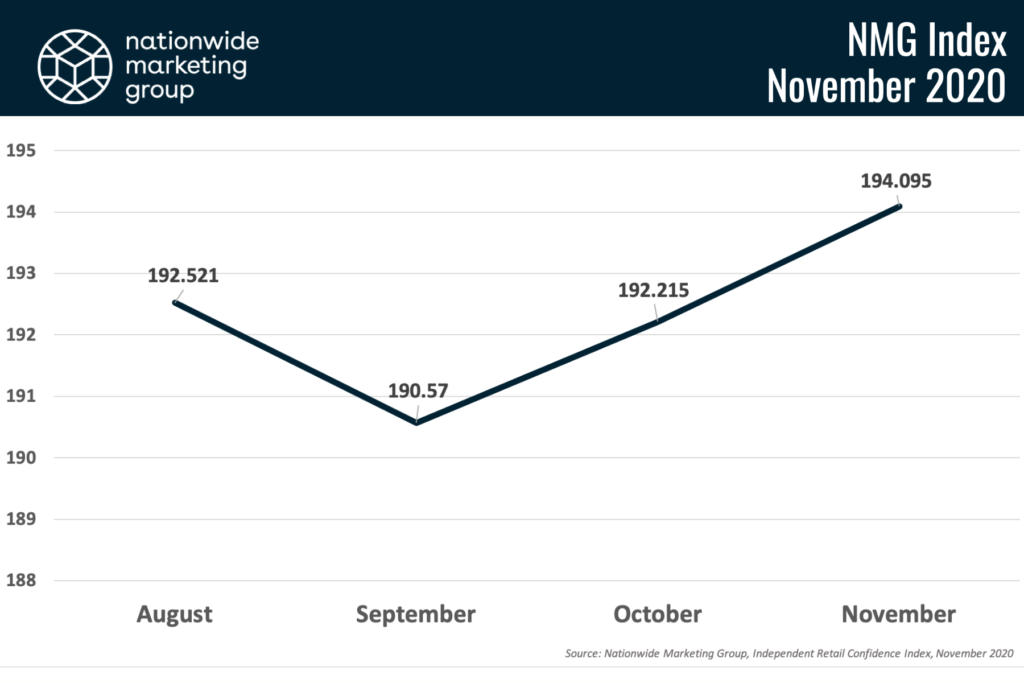

The NMG Index nudged up nearly two points in November to 194.095 (up from 192.2), setting a new high for the four-month-old survey. Percentage-wise, the NMG Index rose roughly half a point to 69.1%.

Much of the boost in confidence, according to retailers’ responses, has to do with strong customer demand that has remained high for several months — in some cases despite there being a lack of promotional activity. The strong demand, though, is still being met with inventory struggles as many retailers still report not being able to get their hands on product to help meet the demand, a sign that manufacturers are still struggling to catch up on orders in the wake of the ongoing COVID-19 pandemic.

Another big uncertain for retailers during this survey cycle was the election. With responses gathered during the final two weeks of October, many dealers reported a “cloudy” future and uncertainty over what the economy will look like — and how it will respond — after the election.

“I have a degree of uncertainty related to the upcoming election,” one retailer responded. “In addition, it is hard to know for certain if the government will in fact enact an additional stimulus bill. I hope after November 3rd there’s some clarity as to future economics. Until then and possibly after it is hard to forecast or elevate confidence above hopeful.”

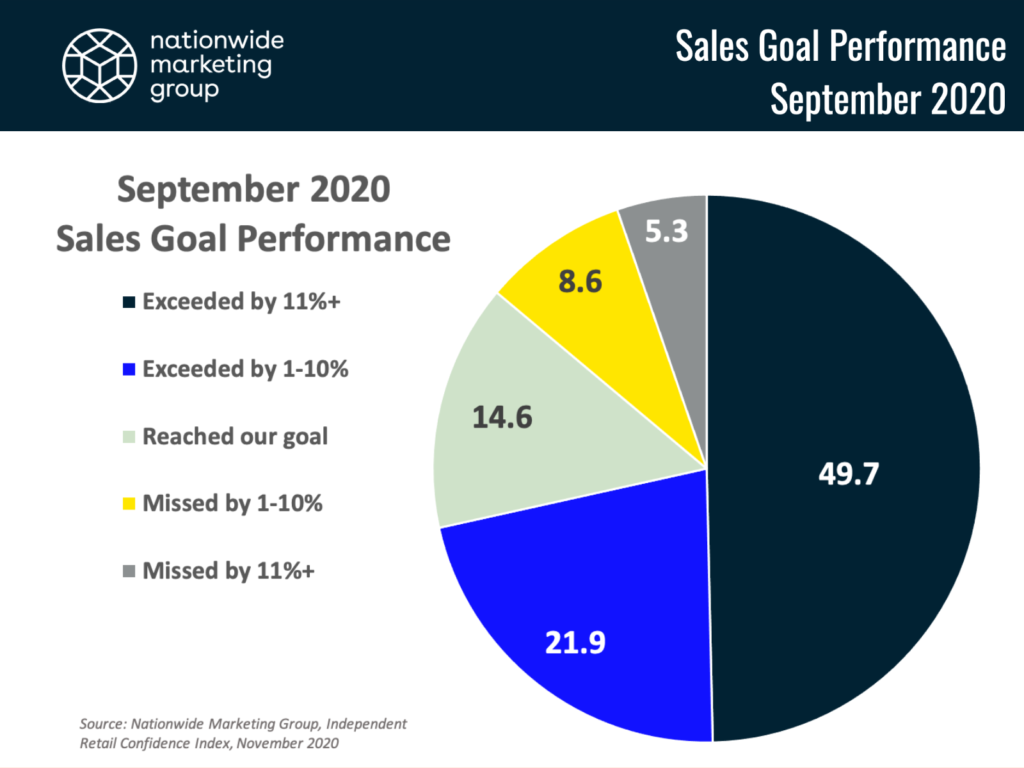

Despite the seeming uneasiness of the elevated confidence level, retailers are continuing to see strong returns in actual sales performance. In September, 85% of responding retailers hit or exceeded their sales goal for that month, a one-point increase over the previous month’s survey.

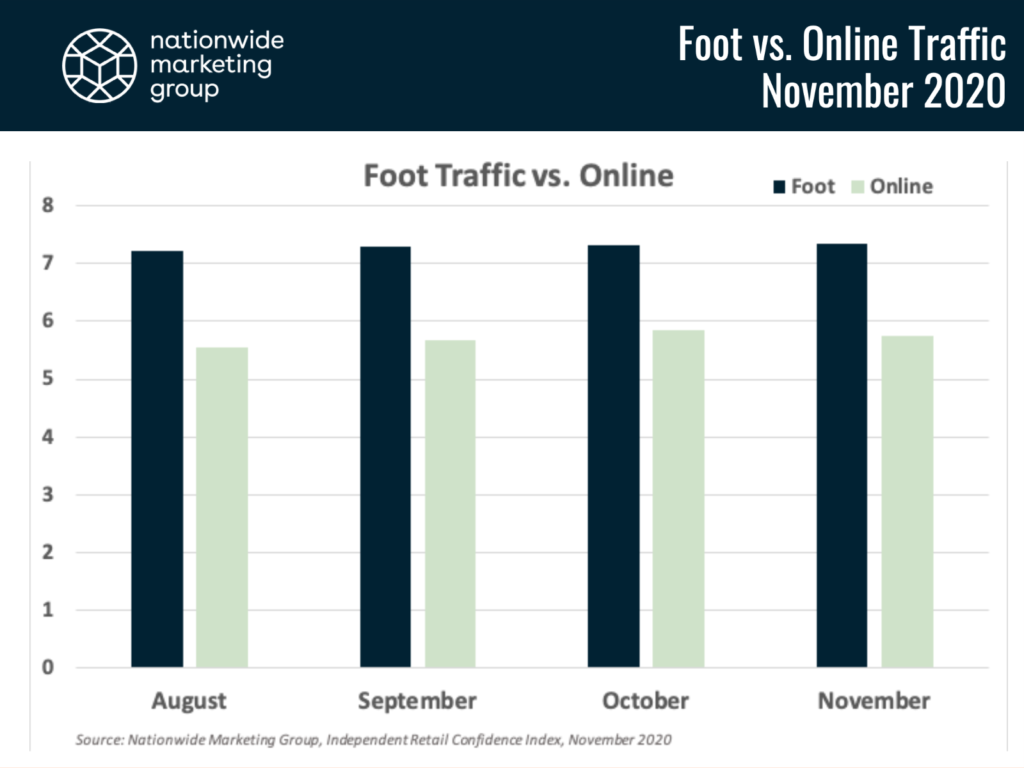

Traffic Patterns

An interesting note in the November NMG Index survey comes in the form of retailers’ confidence in the types of traffic they’ll be able to drive and convert into sales. Over the course of the first four months of the NMG Index, foot traffic has outpaced online traffic by nearly two points. That remained true for November, but the gap actually increased slightly with foot traffic achieving a new high of 7.35 (out of 10) and online traffic falling to 5.74.

A decline in November, even an ever-so-slight one, is the data point of note here. It’s statistically almost irrelevant, but a decline during a month in which Adobe Analytics predicts record online spending gives pause. With a massive opportunity to drive online sales during the height of the holiday shopping season should, in theory, cause retailers’ confidence to spike in that regard, but that’s not reflected in the NMG Index.

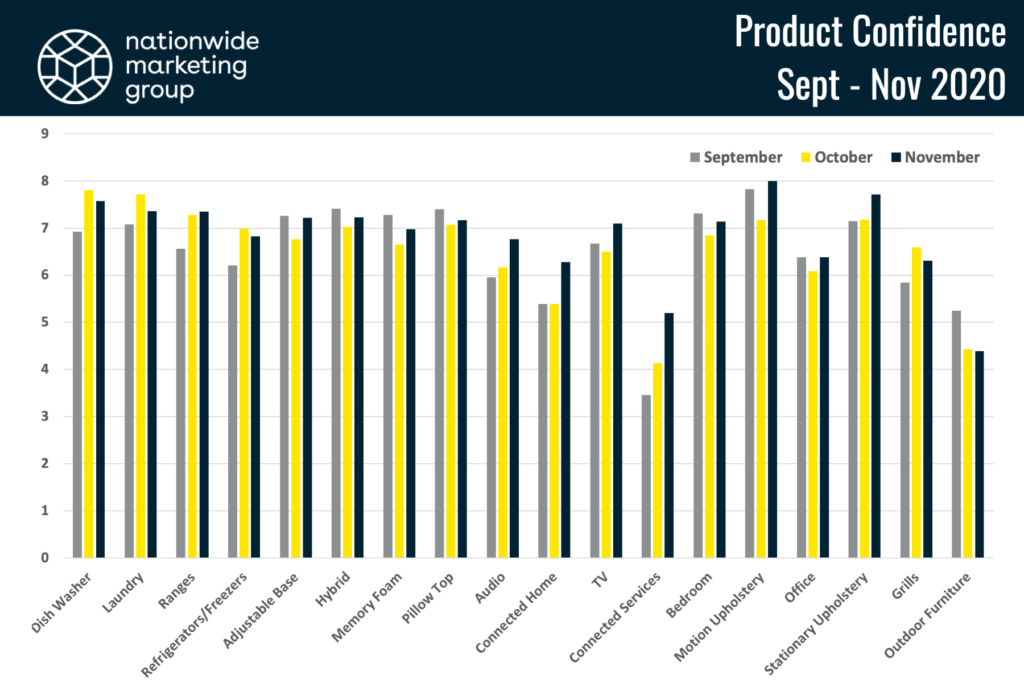

Prospering Products

The collection of 18 product categories that the NMG Index surveys for had their most prosperous month in November. Taking all 18 scores, the products registered an average score of 6.83 (out of 10), which is the highest score in the four months of the NMG Index. Further, looking at the month-over-month trends, 13 of the 18 product categories checked in with higher scores in November, and another eight of the categories had their strongest performing months on record.

Most notably, Connected Services have come on strong since the early NMG Index surveys, increasing by nearly two full points since its September low. The growth can certainly be attributed to popular device launches during this time of year with Apple, Google and Samsung all introducing new product during the last quarter.