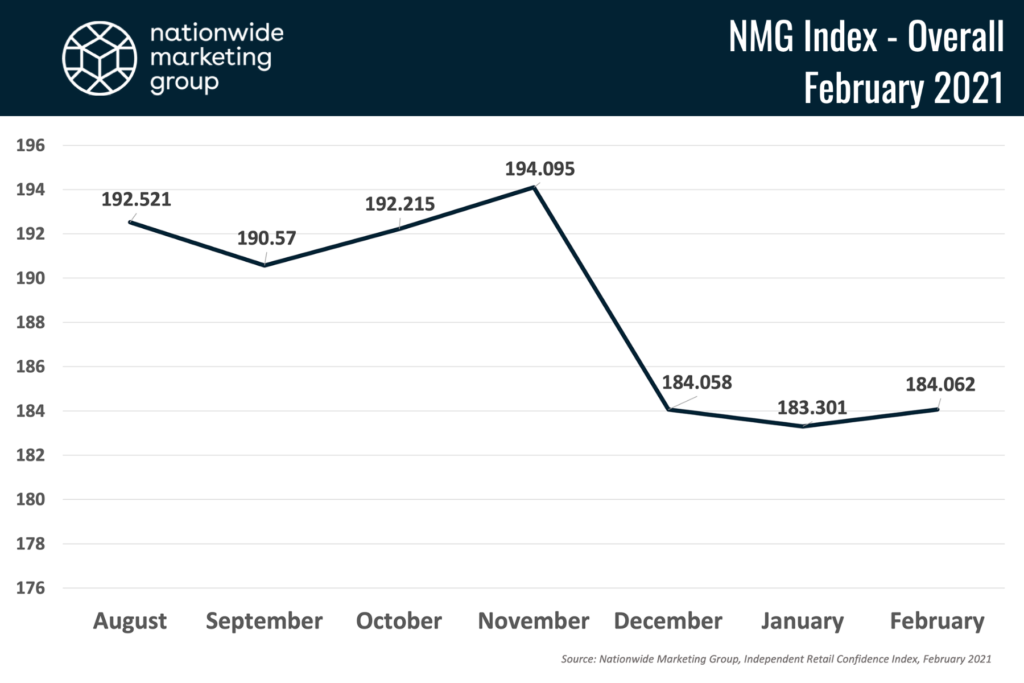

For the third straight month, the Nationwide Marketing Group Independent Retail Confidence Index barely budged. Independent retailers’ confidence level stayed relatively unchanged, moving up roughly one point to 184.06, according to the February NMG Index survey. On the percentage scale, the NMG Index rose a quarter percent to 65.5%.

Many of the same headwinds continue to challenge the Independent retail channel, and retailers who responded to the survey noted as much. Among the major factors impacting their reported confidence level: ongoing concern around the pandemic, supply chain and inventory challenges and uncertainty around the policy direction the new administration will head in. In addition, more retailers pointed to extreme weather as a possible impact on business as we get deeper into the winter months. (In fact, we’re writing this report as the Atlantic and New England states are being walloped by a massive snowstorm. Anyone want to come and help us dig out?)

That said, the tone in retailers’ responses to the survey continues to be overwhelmingly positive and upbeat with many reporting strong sales and demand in their markets.

“Our sales continue to be very strong and are even challenging our best years,” one retailer said. Another added that “store traffic is increasing and consumer comfort to be out in stores is increasing.”

As the COVID vaccine continues to be distributed across the country, and as manufacturers start ramping back up on the production side, it’s our anticipation that both the confidence of retailers and their overall performance will only improve as 2021 marches on.

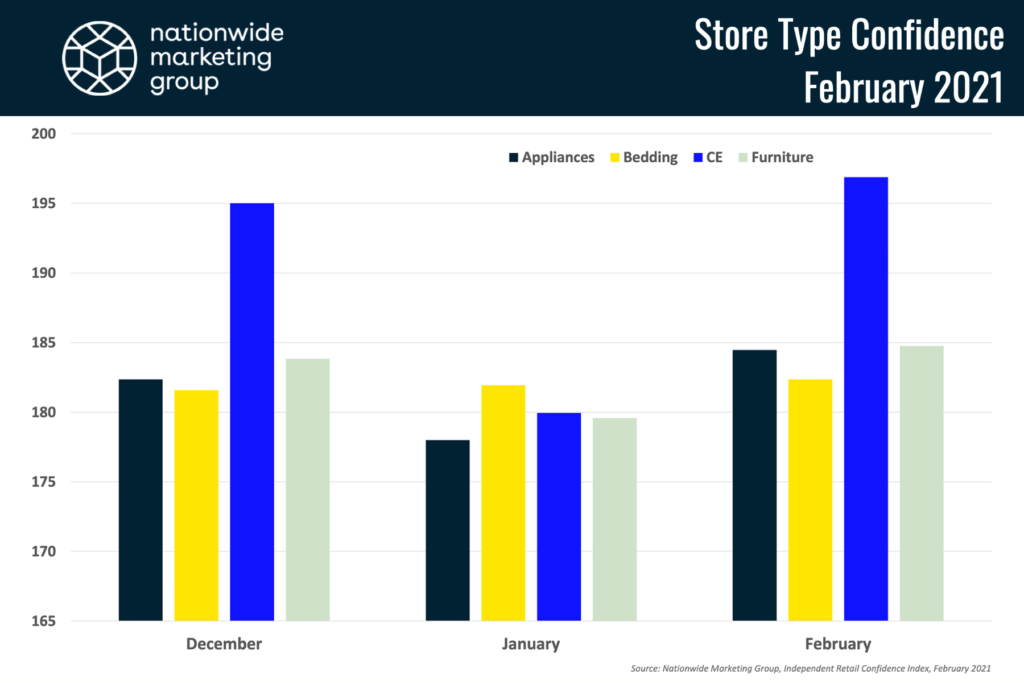

Looked at on a more granular level, Consumer Electronics retailers saw the largest bounce back in their overall confidence in February, jumping nearly 15 points month-over-month. Collectively, all four individual verticals saw their confidence improve month-over-month.

While it’s good to see all categories on the rise, the CE increase is one that should be expected this time of year. We’ll dive into why a little further down when we get into the individual products.

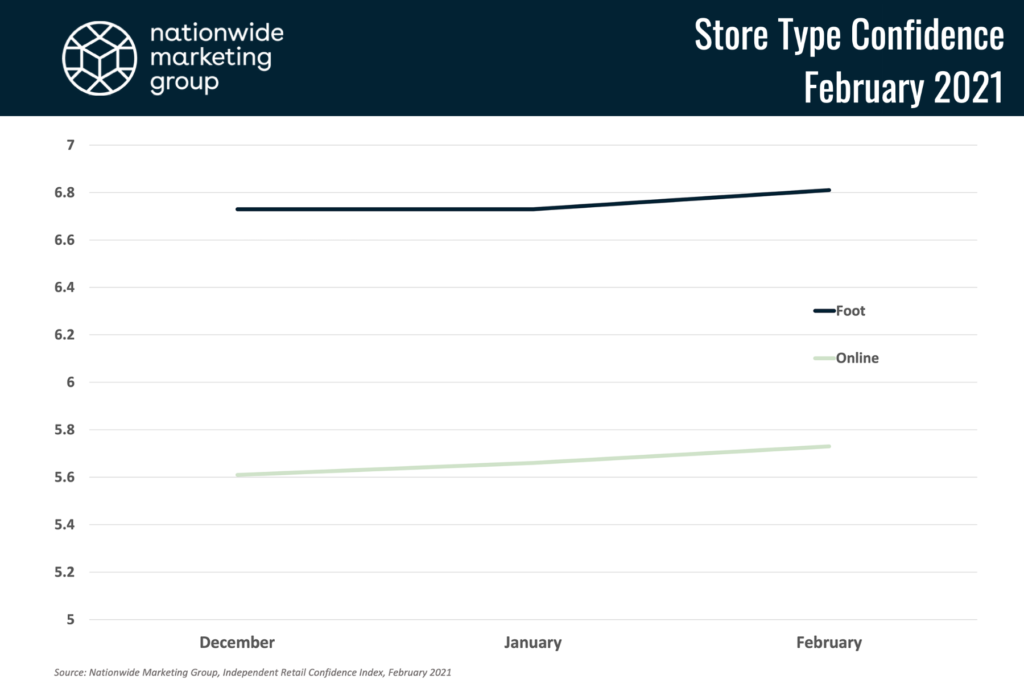

Traffic Confidence Continues to Rise

One of the more encouraging signs from down in the weeds of the February NMG Index survey was the continued improvement in retailers’ confidence around online and foot traffic. The increases month-over-month were subtle on both fronts, but since the first NMG Index survey back in August, these numbers haven’t really seen big jumps in one direction or the other. However, the fact that both have consistently improved is a positive sign for retailers.

According to retailers who responded to the February survey, the hang ups on the foot traffic side include continued uneasiness around the coronavirus pandemic and uncertainty with weather — the latter of which is a common thread during the winter months.

For online conversions, the main challenge continues to be overall adoption. Beyond that, many retailers reported strong performance in the ecommerce space during the previous months, which they expect to continue into February and beyond.

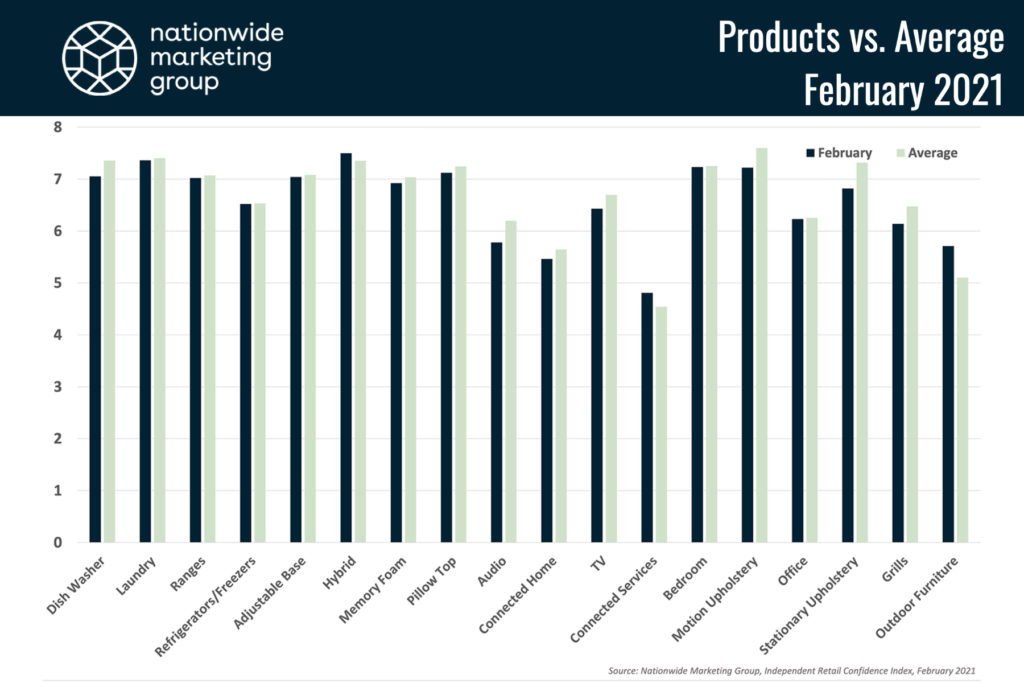

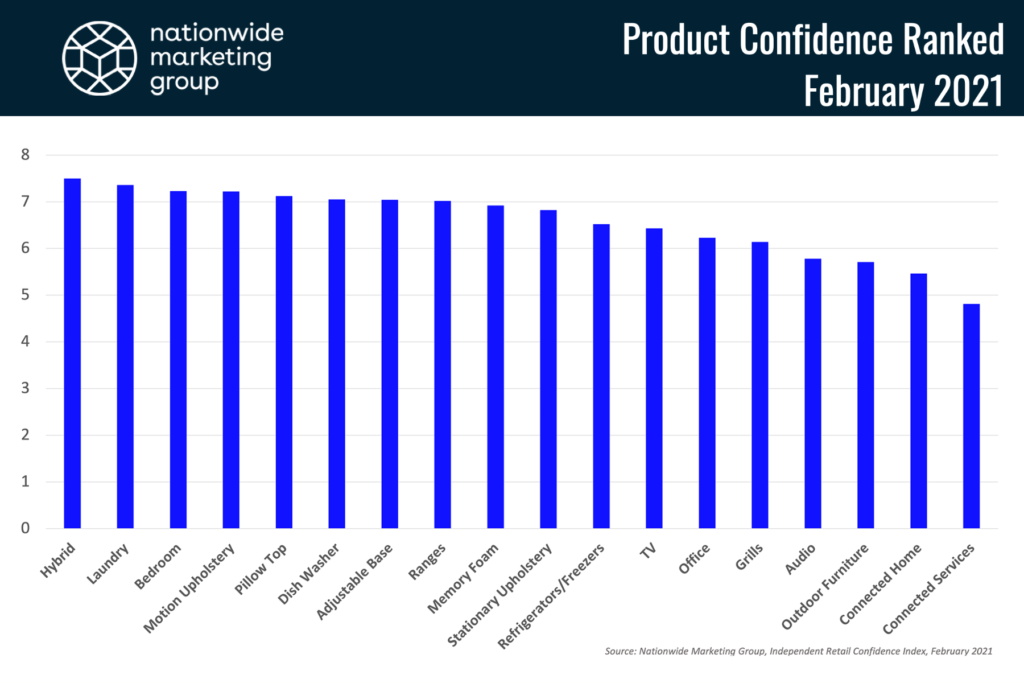

Products Remain Relatively Flat

Even in a “status quo” kind of month, you expect to see at least some movement in the breakdown of individual products. However, in February, all products saw their score land within 0.5 points of their overall average. In fact, nine of the 18 categories were within one-tenth of their average score.

One category that needs to be pointed out this month is TV. It falls around the middle of the pack as far as where it stands in relation to the other product categories. But TV is typically a strong product in the first two months of the year as retailers prepare and execute around Super Bowl promotions. TV didn’t explicitly show big gains in the product portion of the survey, but the increase in CE retailers’ confidence suggests they anticipate strong performance around the category this month.

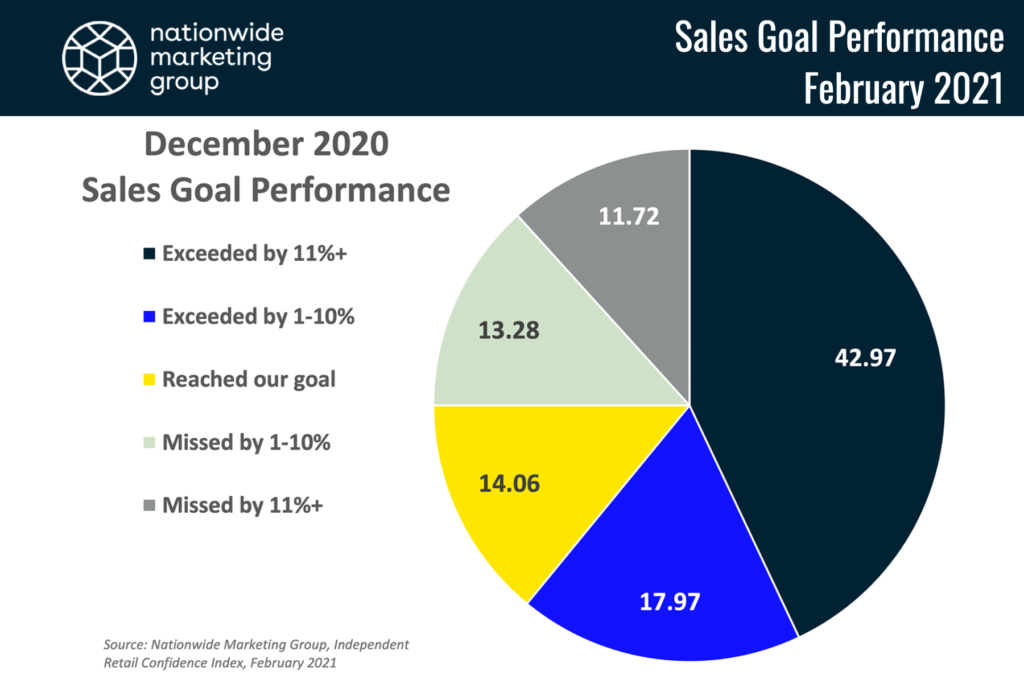

Sales Were Mixed

Sales performance in December 2020 was a bit of a mixed bag, according to the February NMG Index survey. There was a big jump — more than 7% — in the number of retailers who exceeded their sales goals by 11% or more. But that was somewhat offset by increases in those who missed their goals by 1-10% (which rose 2.5% from November) and those who missed by 11% or more (up 0.5%).