If there’s one thing that the latest National Kitchen & Bath Association (NKBA) quarterly report told us, it’s that Independent retailers are not alone if they’re feeling the pinch right now. According to the association’s Q3 Kitchen and Bath Market Index (KBMI) report, K&B dealers saw sales dip 1.3 percent compared to the same quarter a year ago.

Any drop in revenue isn’t great news. But, if there’s one good thing that retailers can take out of the report, it’s that the decline wasn’t as bad as last quarter’s, which was down 3.3 percent.

NKBA members surveyed for the report pointed to higher interest rates, economic uncertainty and higher prices for kitchen and bath product for the continued negative growth. Consumers, they said, were focused more on their “needs” versus their “wants.”

It was a similar set of results for foot traffic during Q3 at retail as well, according to the KBMI report. Retailers said that foot traffic was off by about 3 percent quarter-over-quarter in Q3 – not great, but better than the 8 percent decline that was reported in Q2.

The overall KBMI, which aggregates responses from throughout the survey and across various segments of the K&B industry, checked in at a 53 out of 100. That’s down two points quarter-over-quarter, showing that the industry maintains its cautious outlook for the near-term. And that’s not surprising, given slowing macroeconomic data around home starts, interest rates, etc.

However, looking ahead to 2024, and especially the latter months of the year, K&B industry professionals remain very optimistic, according to this report.

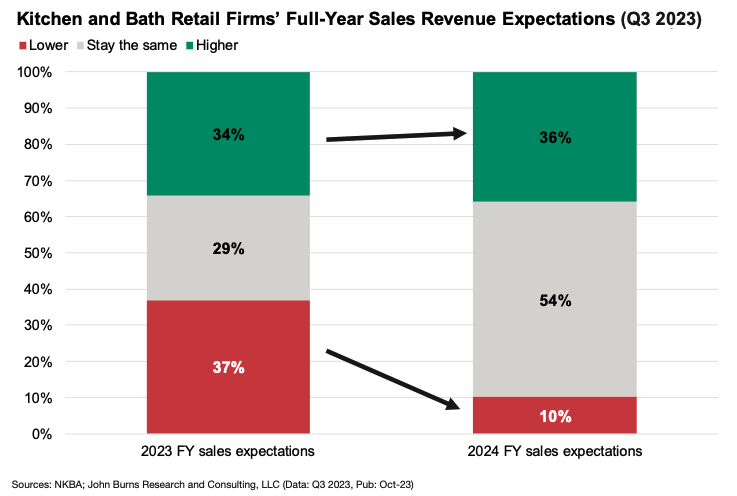

Narrowing in on the retail portion of the NKBA membership, those dealers generally do not expect a dip in sales next year, which is a vast improvement over their expectations for 2023 as a whole. According to the Q3 KBMI report, 36 percent of retailers surveyed said they anticipate a revenue increase next year (up from 34 percent this year), while just 10 percent believe they’ll experience a revenue decline (down from 37 percent this year).

As for sales right now, 34 percent of retailers surveyed by NKBA said that customers are shifting to lower-priced product, an increase from the 23 percent who said the same last quarter.