It’s no huge secret: Consumers have significantly altered their shopping habits over the course of the past three months as the COVID-19 global pandemic has continued to impact our everyday lives. But now, for the first time, we have a slightly clearer picture of the financial significance of consumers’ shifting shopping habits.

Earlier this year, Adobe Analytics unveiled its new Digital Economy Index, a report that analyzes more than 1 trillion visits to retail websites and over 100 million SKUs to gauge the “buying power of digital consumers.” Now in its fourth month, the report shows just how wide the gap is between what Adobe’s analysts predicted for online spend during the first half of 2020 and how much consumers have actually doled out.

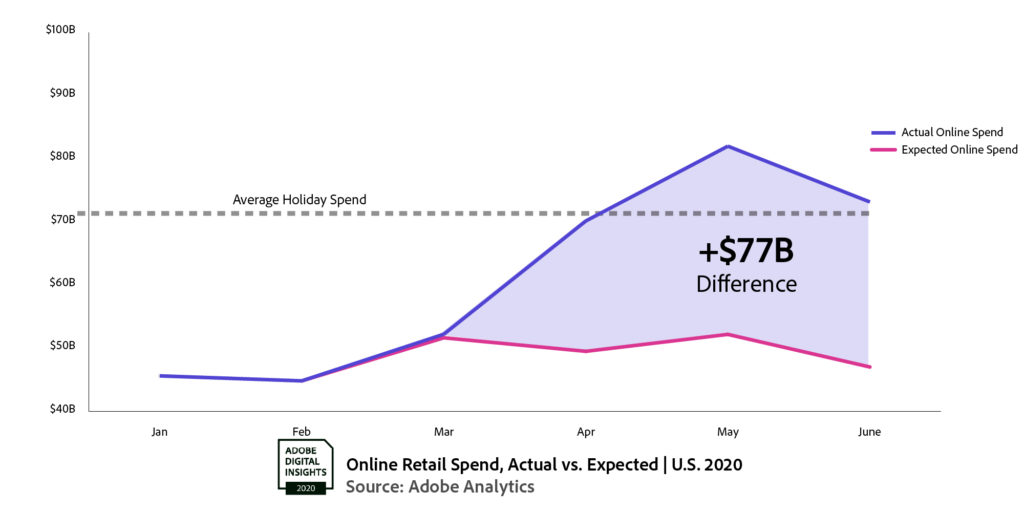

According to Adobe’s data, consumers have spent more than $70 billion per month online during the April-June period as lockdowns persisted throughout the country because of the coronavirus pandemic. In May, consumers spent more than $80 billion with online retailers. By comparison, the average monthly spend during the holiday shopping season is roughly $70 billion, according to Adobe.

For the period between March and June, consumers’ actual spend outpaced what Adobe analysts had predicted by $77 billion, the report says. That gap equates to just about half of the entire 2019 holiday shopping season.

Digging deeper, Adobe’s report showed that it’s not just loyal online shoppers who are spending more. From April through June, new customers (those with no previous online purchases) and returning customers (those with only one previous purchase) represented the bulk of the increase in spend online. Adobe expects that influx to slow as these new and returning customers are converted to loyal online shoppers moving forward.

Adobe’s data also showed that customers have taken a significant interest in the BOPIS option (buy online, pickup in store) as they shop online. The YoY growth in BOPIS dipped slightly in June as stores across the country began slowly reopening, but it was still up 130% over 2019. Between April and May, the height of the lockdowns, BOPIS orders were up more than 300% over 2019 levels. Adobe’s report found that 23% of online consumers prefer BOPIS or curbside pickups over having their purchases delivered.

All of this is to say retailers need to place a strong emphasis on having a sound e-commerce strategy. Now, more than ever, as consumers are continuing to practice social distancing — and as local communities face the possibility of falling back into lockdown as the coronavirus surges back — retailers have the opportunity to capture that online business.

Ready to Upgrade Your Website?

Are you getting the most out of your retail website? If you’re ready to upgrade your business’s digital presence, we can help! Our partners at Site on Time and Retailer Web Services offer a seamless experience that can:

- Help you generate rich product pages

- Integrate a customizable e-commerce experience that benefits your business

- Track customer shopping behavior

- Drive traffic to your store, and more!

Click here to learn more.