Growing up, there was this relatively popular PBS show that I would occasionally watch called Lamb Chop. Despite only being on TV for three years, the show has had a lasting pop culture impact. Depending on your recollection of the show, and whether you were a parent or the child watching, the mere mention of “The Song That Doesn’t End” brings back either fond or horrific memories. Either way, it’s a tune that will likely be stuck in your head for the next few moments. (Sorry!)

I bring it up because, much like how that never-ending song has outlived the show itself, there’s been a never-ending “debate” floating around the retail industry that has really outstayed its welcome: the impending doom of brick-and-mortar retail.

Every so often, for one reason or another, industry analysts get themselves worked up talking about the “retail apocalypse” or the “death of brick-and-mortar.” It’s something that happens almost on an annual basis and has been going on for at least the past decade as the world of e-commerce expands and evolves.

To be fair, those headlines are a great way to generate clicks and pageviews. But if you follow the actual data that’s available for the retail industry, you’ll see that those predictions of the end of in-person shopping are so vastly overexaggerated — as one analyst recently pointed out to Yahoo! Finance.

Let’s briefly dive into two truths about the retail industry that’ll help you really understand what’s going on.

Brick-and-mortar isn’t going anywhere.

In 2020, e-commerce accounted for roughly 18 percent of the total retail volume globally. That number is expected to continue to rise, but it still shows that over 80 percent of retail sales are done in-store.

Of course, the pandemic helped to accelerate the growth of e-commerce and consumers’ comfort level buying product online. But even so, retailers have had success turning those digital purchases into in-store visits. Buy-online-pickup-in-store (BOPIS), which exploded during the past two years, drove over $72.4 billion in sales in the U.S. last year — a 107 percent growth rate over 2019.

And if that’s not enough to help get across the staying power of brick-and-mortar stores, the NRF shared strong numbers from Q1 2022 that show U.S.-based retailers plan to open 4,400 stores and close only about 635 stores this year. That follows the trade association’s 2021 store openings report that showed U.S. retailers opened twice as many stores as they closed.

Another reason why in-person shopping remains important? Consumers actually enjoy the experience. According to Morning Consult’s State of Retail & E-Commerce report, more than two-thirds of shoppers prefer to do their browsing in-store, especially when it comes to home furnishings and appliances.

Hard data from the U.S. Census Bureau also shows that in-store shopping is not only surviving, it’s actually thriving. Coming off of a 2021 that saw in-store retail sales across the U.S. rebound tremendously after the “great re-opening,” year-over-year data continues to impress. In July, in-store retail sales in the U.S. were up 10.3 percent over last year. That follows May and June data that was up 8.7 percent and 8.5 percent, respectively, over last year.

This isn’t an independent problem.

Businesses open and close every day — independent ones included. But the conversation around the death of the physical store hasn’t been driven by some great exodus of local, family-run businesses from communities across the country. Rather, it’s the regular announcements made by big box brands that they’re closing up shop and leaving large gaps in strip malls around the country that fan the flames of this so-called debate.

Within just the past few weeks it’s been reported that sports retailer Olympia plans to close all of its 70 locations, Bloomingdales and Sears are paring down their store counts even further, Bed Bath & Beyond plans to close 150 locations and lay off 20 percent of its workforce, and the list goes on.

At our recent PrimeTime event in Orlando, we heard Wells Fargo economist Charlie Dougherty talk about how the economy is normalizing itself back to pre-pandemic times. The same could probably be said about the physical retail space across the country — particularly when it comes to big box locations and malls.

There’s no denying that American consumers love to shop, and it’s led to a major influx of physical retail locations over the years. Where else in the world can you find a country with not just one but 22 (two-two!) malls with at least 2 million square feet of leasable retail space? Nowhere. That’s the answer.

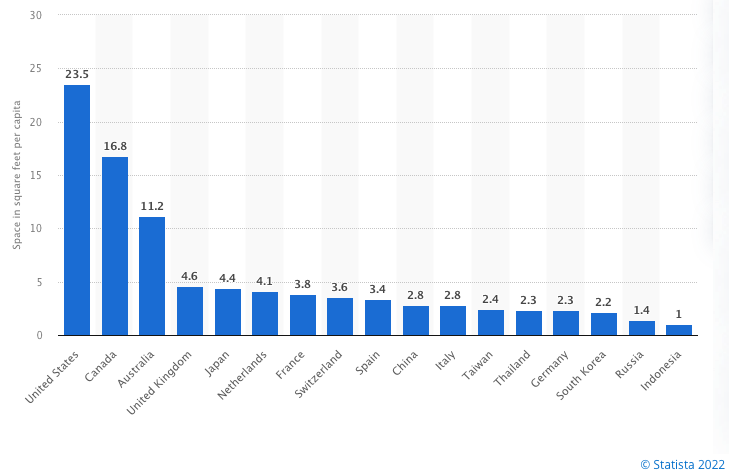

One of my favorite charts from Statista (embedded below) shows just how bloated our land is with retail space. As of 2018, the U.S. touted 23.5 square feet of retail space per capita. That might sound spacious compared to a studio apartment in New York City, but the next closest countries, Canada and Australia, check in at 16.8 square feet and 11.2 square feet, respectively. Further, you’d have to combine the per capita square footage of the U.K., Japan, the Netherlands, France, Switzerland and Spain (countries ranked 4-9 on the list) in order to outpace the U.S. ever-so-slightly — they total 23.9 square.

Just to reiterate, this isn’t an independent retail problem. The empty spaces left in our strip malls and major shopping centers are there because of over-expansion by large businesses. That’s why we see malls being repurposed across the country in unique ways. And it’s why we see independents moving into those abandoned locations to better serve a community. NMG Member Queen City Audio Video & Appliances plans to do just that in Winston-Salem later this year when they complete their takeover of a shuttered big box office retail location.

Long story short, don’t let the mention of the death of brick and mortar scare you. You’ve lived through at least six supposed retail apocalypses over the past decade, if you’re to believe the hype. And if the past two years have shown us anything, it’s that the independent channel has always been and will continue to be a resilient bunch. So, just hum along while that never-ending song continues to be sung.