The first quarter of 2025 is officially a wrap.

As we look back on Q1 results year-over-year, it also seems relevant to review 2024 results as well, for a broader comparison and overall outlook.

Each month, the U.S. Commerce Department’s Census Bureau releases a report on the previous month’s year-over-year (YOY) retail sales. The report includes a breakdown by total retail and total e-commerce sales as well as performance in specific retail categories — including furniture and home furnishings, electronics and appliances, department stores, general merchandise, grocery and more.

Today, we’re taking a closer look at the two categories best aligned with Nationwide Marketing Group’s Independent retail membership — (1) furniture and home goods and (2) electronics and appliances — along with total e-commerce across all categories.

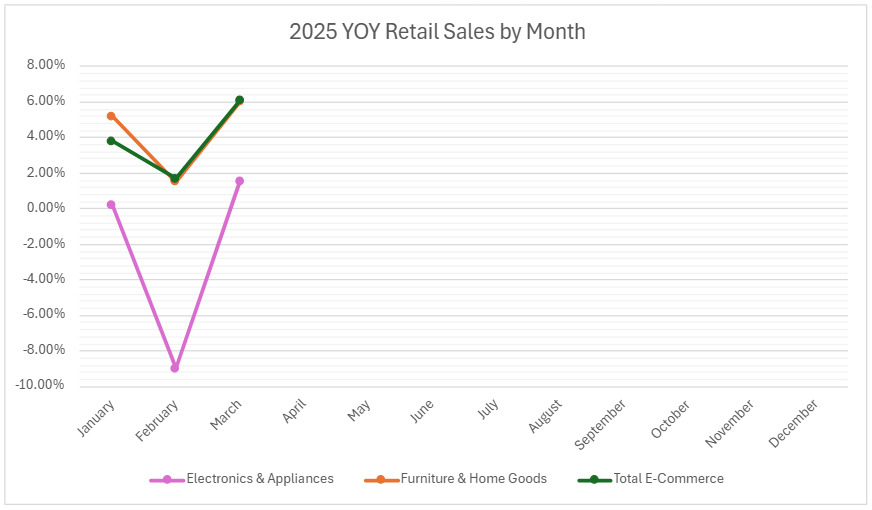

YOY Retail Sales by Month for Q1 2025

Overall, 2025 had an okay start in these categories, with February bringing down the average across the board.

Here is the breakdown, month by month for January, February, and March of this year.

“While the figures will come as a relief to a retail sector that has recently been battered by a welter of bad news and disruption, we caution that the rates of growth this month are not necessarily representative of what the balance of the year may produce,” noted Neil Saunders, managing director of GlobalData, in a message to Retail Dive.

And, according to Retail Dive, the National Retail Federation agrees that “shoppers may be doom-spending ahead of potential price hikes.”

As we close the month of April and anticipate results for the start of Q2, let’s now look back at last year for a more comprehensive perspective.

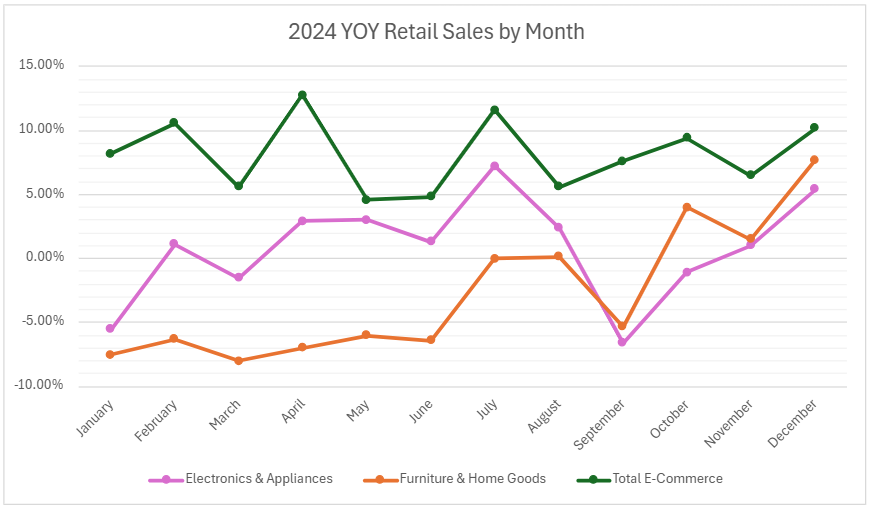

2024 YOY Retail Sales by Month in the U.S.

Wells Fargo economists called 2024 “a decent year for retailers,” even as these results did not meet all expectations.

This chart shows the YOY percent increase or decrease in each category, by month.

2024 U.S. E-Commerce Sales

Notice that, although the results vary widely month-to-month, last year’s e-commerce sales never once decreased when compared to the same period in 2023. And four months saw jumps over 10 percent YOY.

Online retail news platform Retail Dive shares experts’ analysis as to the why behind these increases. For example, while the February boost could be attributed to Leap Day, the 12.8 percent rise in April was due, at least in part, to higher-than-average tax returns, coupled with wage increases that outpaced inflation around that period. And in July, Amazon Prime Day — and other competing sales that month — certainly contributed to another e-commerce spike at 11.6 percent YOY.

Of course, an e-commerce boost was expected in December, especially with more consumers taking advantage of buy now, pay later plans.

In all, 2024 was a big year for e-commerce, even as in-store shopping has made a strong comeback since the pandemic.

2024 U.S. Electronics and Appliances Sales

While a post-holiday slump in sales is not uncommon, Bankrate Senior Industry Analyst Ted Rossman, noted that record-high credit card debt could also have contributed to consumers’ conservative spending at the beginning of 2024.

Overall, the electronics and appliances category had its ups and downs, with peaks in July and December, and a massive drop at the end of Q3. Given the abundance of both mid-summer and year-end sales, this trajectory is not altogether surprising, given the dips before and after major sale periods.

2024 Furniture and Home Furnishings Sales

The furniture and home furnishings category struggled to stay in the positive last year but ended on a high note with all three months of Q4 up YOY to 2023. Foot traffic also increased in Q4 with a 3.5 percent YOY increase, which not only helped to boost total sales but also offers hope for 2025.

2025 Q2 Outlook

As we swing back to the present, one thing stands out. Year-over-year e-commerce sales have been constant in terms of positive YOY growth — as more and more consumers take advantage of online shopping.

No matter the state of the economy, having a solid online presence and digital strategy is becoming increasingly crucial to meet customers where they are at any given stage of the shopper journey.

LOOKING TO GROW your online sales this year? Learn more about OneShop.