Bob Dylan put it best when he penned the lyrics to “The Times They Are A-Changin’,” saying that “if your time to you is worth savin’ then you better start swimmin’, or you’ll sink like a stone for the times they are a-changin’.” Those words almost definitely were him foretelling the coming age of alternative payments on retailers’ websites in the 21st century – good luck changing my mind.

Lyrical dissections aside, if you’ve built yourself a website for your retail business and you’re not providing your customers with the opportunity to use alternative payment methods, you are 100 percent leaving potential sales on the table. End of discussion.

If you’re not familiar with the term, alternative payments are considered to be any form of payment or payment plan that goes beyond the methods of cash, check, credit card or traditional financing options. Think, PayPal, buy-now-pay-later options, eWallet or mobile point-of-sale payments and the like.

Here’s the thing, though. The conversation around alternative payments traditionally has revolved around the website experience. And while that’s certainly still important – and a main point of emphasis here – there’s also an opportunity to increase sales in your store by offering these nontraditional ways to transact.

Want to add PayPal Pay Later to your website? Reach out today to learn more.

Rather than preach at a high level on the subject, lets instead dive into a few different charts that help make the case for these alternative payment methods.

Mobile Wallets on the Rise

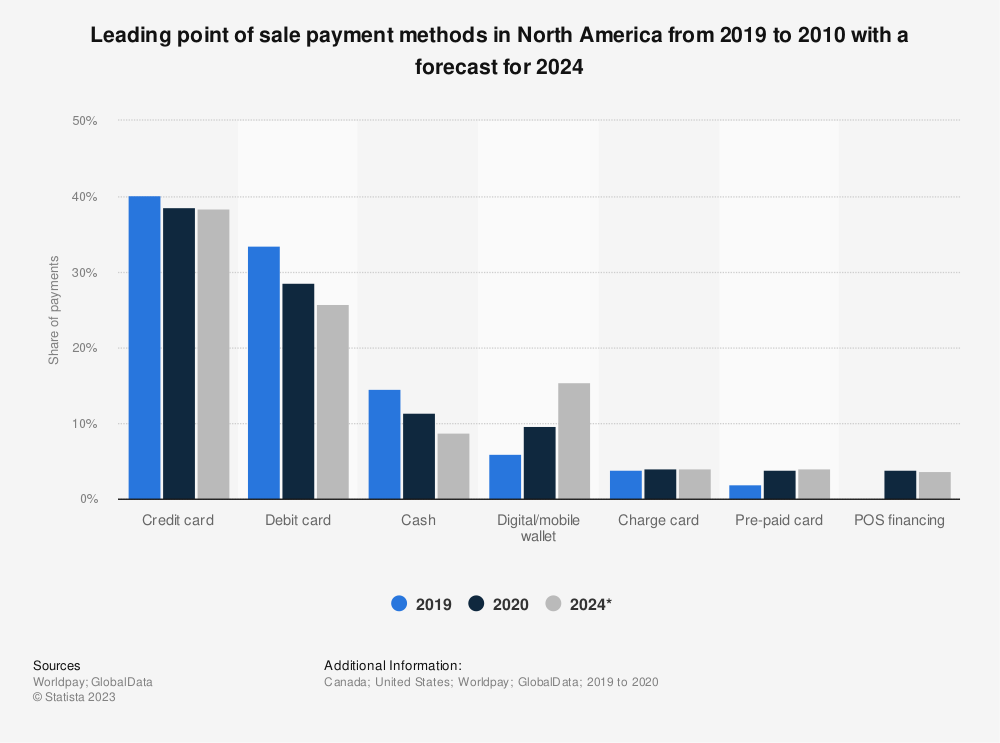

Just about every single traditional payment method has seen a drop off in usage over the past three years. And it has everything to do with the rise of the mobile wallet. Roughly 15.5 percent of all North American POS transactions are expected to be those tap-and-go payments, according to a recent Global Payments Report, up from just 6 percent in 2019. There were an estimated 4.4 billion contactless payments made in 2022 (just counting those made with smartphones or wearables, not those cards with tap-to-pay tech built it), and that number is expected to jump to 8.3 billion by 2027.

Ease of use is the biggest advantage for the consumer with this form of payment both in-store and online. FaceID and similar technologies make it a secure method of payment, and stored billing and shipment information make it an incredibly convenient and fast way to check out on a retailer’s website.

BNPL on a Meteoric Rise

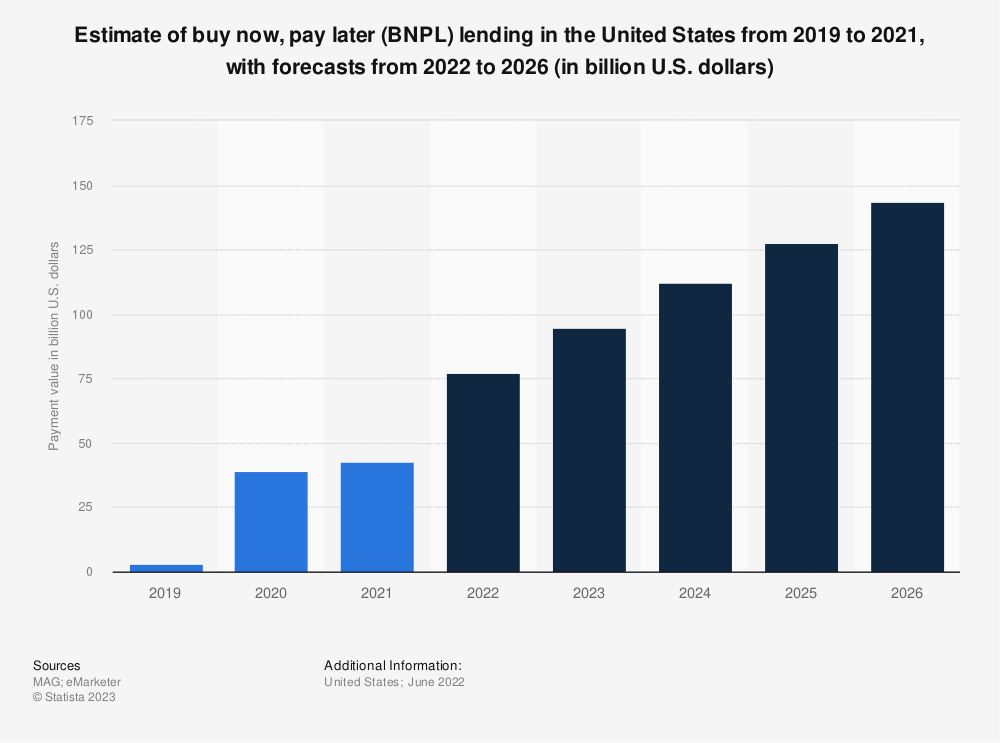

Thought it took off during the pandemic, buy-now-pay-later is showing no signs of slowing down. Consumers spent a little more than $77 billion using those split-payment or pay-in-four type options available through firms like PayPal, Zip and others. While certainly a high number, data shows it could nearly double over the next few years.

Share of BNPL

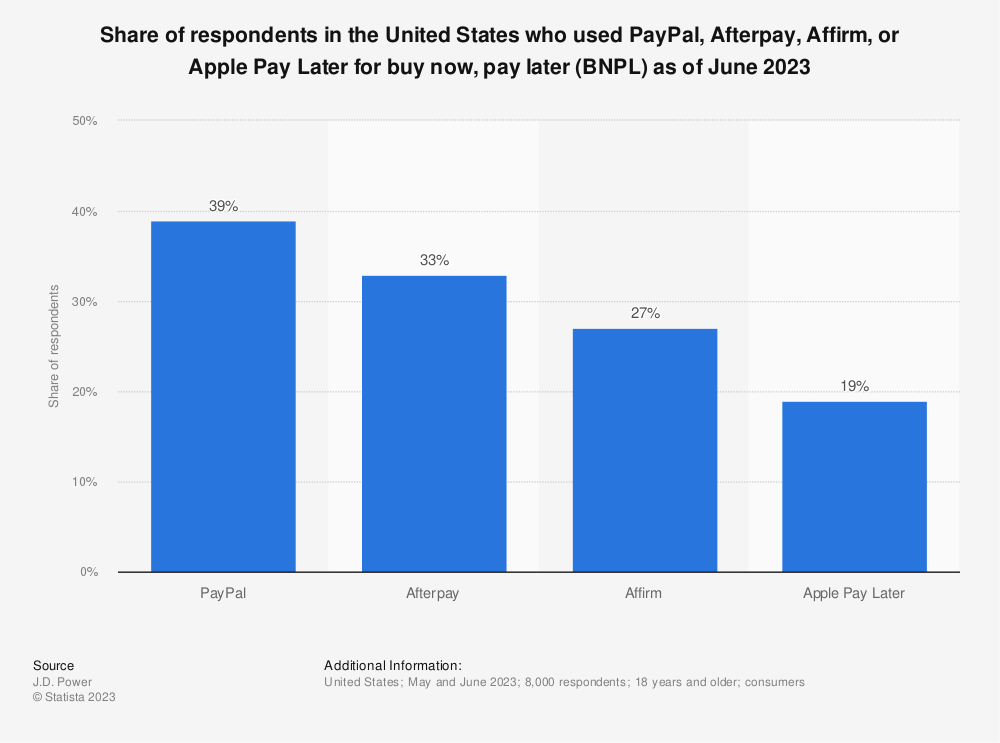

Speaking of PayPal, they are among the leading brands consumers turn to for those BNPL purchases, according to J.D. Power. In a recent survey, they found that PayPal (used by 39 percent of consumers) outpaced other notable brands including Afterpay (33 percent), Affirm (27 percent) and Apple Pay Later (19 percent).

Prevalence of PayPal

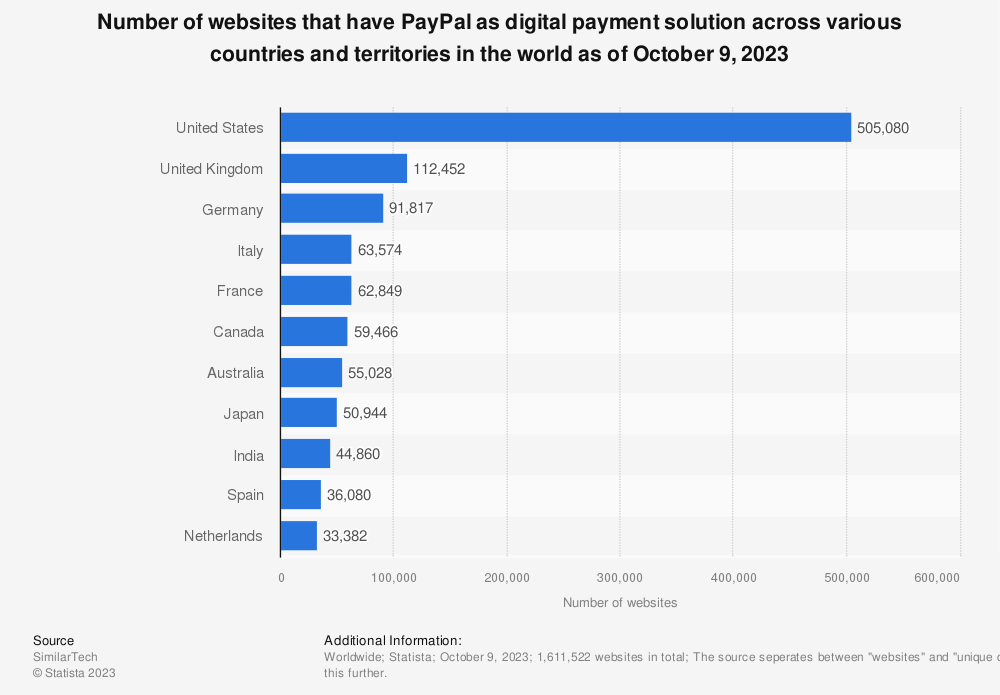

It’s known that the U.S. consumer is among the most active when it comes to online shopping. As such, ecommerce brands have tailored their websites to improve the experience for their digital shoppers. Notably, PayPal is available on over 505,000 different websites as of October 2023. And with an active user base of more than 430 million, it’s safe to say that when a shopper lands on your website they’re expecting to see PayPal as an option during the checkout process.

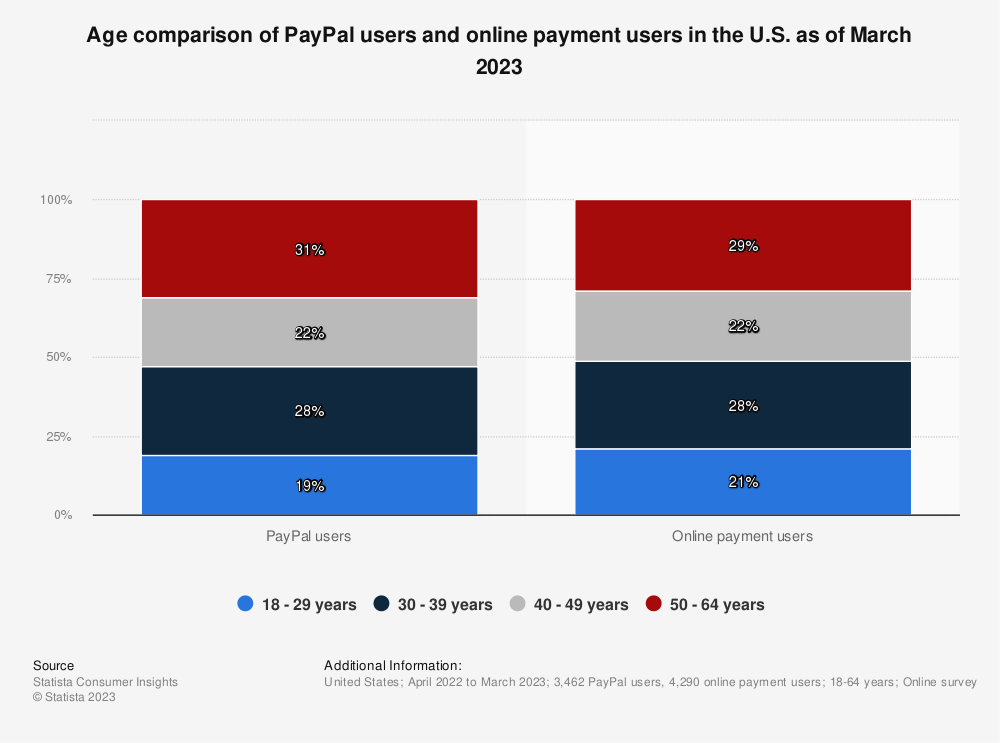

Average User Age May Shock You

Of all the charts that we came across on the alternative payment market, this last one was actually the most surprising to us. With the largest user base across the alternative payment spectrum, PayPal users provide a very accurate representation of the online payment landscape. So, seeing that 31 percent of users were between 50-64 years old – the largest age group in the survey – was a bit surprising. Even looking at the overall makeup of the online payment user base, the older generation holds steady with those elder millennials.

What this tells us is that even older generations are turning to alternative payment methods to complete their purchases, which likely dispels any myths you might’ve had about who is actually making these purchases.

The times they really are a-changin’.