The April Spring Savings Promo Recap is live!

Our post-promo performance report serves to provide Members of Nationwide Marketing Group (NMG) with crucial information driven by our proprietary PriMetrix data — giving you a look at market trends, the ability to benchmark your performance, and make informed business decisions to keep you ahead of those big box competitors and even other local retailers.

It’s no news that the home appliance sector is navigating a complex economic landscape, with tariffs and looming price increases leading the way. Yet, April proved to be a very successful selling period with more consumers in-market in an attempt to beat tariff impacts.

Our April Spring Savings Retail Report breaks down several key wins for this promotional period, including:

- Year-over-year (YoY) dollar and unit increases

- Overall manufacturer performance, both YoY and as a percent of market share

- E-commerce boost for retailers using NMG OneShop digital services

- Continued success of single unit rebate strategy

Double Digit Increases YoY in Dollars and Units

Industry and economic headwinds proved to be a significant motivator in the marketplace, as NMG Members saw YoY increases in units and dollars, up 20.7 percent and 16.8 percent respectively. This year-over-year view aligns with last year’s 21-day spring promotional period for a true side-by-side comparison.

Appliance Manufacturer Performance in Dollars and Units

During this spring promo period, all manufacturers saw a boost in both dollars and units YoY. Laundry was the winning product category, up 21.0 percent in dollars and 22.9 percent in units — also accounting for six of the top 10 selling units during this period. Yet laundry wasn’t the only winner, as all appliance categories saw an increase YoY.

OneShop E-Commerce Performance

Significant increases continue promo after promo for participating NMG retailers who utilize our OneShop digital services. For this promotional period, increases include double-digit gains in number of e-commerce orders and online average ticket YoY, with triple-digit gains in e-commerce revenue.

Duress Purchases and Single Unit Rebate Strategy

Average selling price (ASP) continues to grow for NMG Members. For the Spring Savings Promo, ASPs were up 7 percent YoY, and up 61 percent to the total industry. Once again, NMG’s single unit rebate strategy helped to drive this average increase.

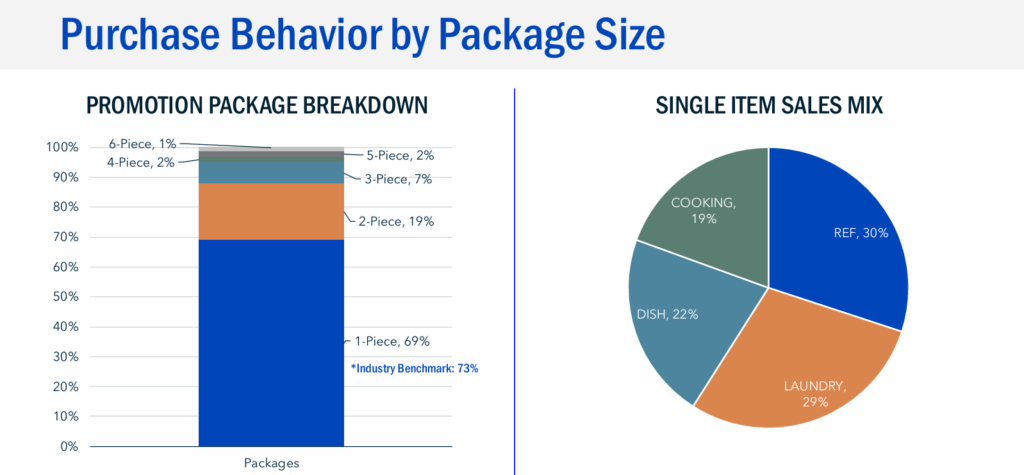

The PriMetrix data shows that 69 percent of spring promo purchasers bought one appliance item and 19 percent bought two items. Of the single unit tickets, refrigeration and laundry were neck-and-neck as top performing categories, at 30 percent and 29 percent respectively.

Results from the PriMetrix Spring Promo Report

And this is just a peek at what you’ll find in the full report. Ready to learn more?

CLICK HERE to view the Spring Savings Retail Report *MemberNet login required

About PriMetrix

PriMetrix provides NMG Members with unmatched data and analytics to help drive their business. Complete with three different tools, our industry exclusive insights give our Members everything they need to analyze their market, benchmark their business against the aggregate of the membership, and optimize their SKU assortment.