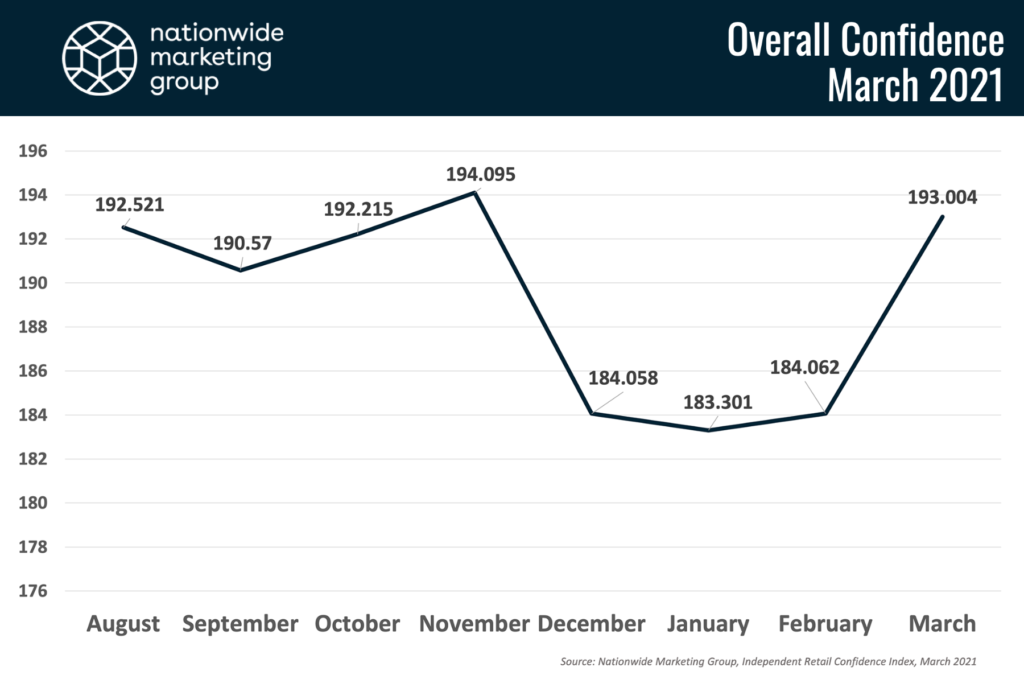

Nationwide Marketing Group’s Independent Retail Confidence Index saw its second-strongest month on record heading into March as Independent retailers start to see a light at the end of the long and winding tunnel that has been the past year.

Overall confidence checked in at 193.004, according to the latest survey, up just shy of nine points from the previous month. On the percentage scale, the NMG Index rose to 68.7%, up more than 3% from February.

The climb in confidence comes as retailers continue to deal with supply shortages. However, the boom can be credited to a number of factors. Among them, retailers anticipate spending to increase as Congress prepares another round of COVID stimulus relief checks and as tax refunds continue to hit consumers’ bank accounts.

Another reason for some additional positivity heading into March, according to retailers who took the survey — they’re coming up against year-over-year sales projections for March 2020. Considering how soft that month was for the retail industry one year ago, many view March 2021 as an opportunity to achieve strong year-over-year gains.

Retailers who were particularly smart about their inventory planning and marketing efforts around available product, this should certainly be the case. “Severe supply shortages continue to put us at a strategic advantage over competitors due to our inventory capacity,” reported one retailer.

What’s clear across the board from all retailers is that consumer demand remains strong. Severe weather, supply challenges and the ongoing pandemic have presented retailers with their own hurdles in meeting that demand. But they haven’t done anything to reduce the readiness of shoppers to get out (or get online) and spend.

Strong Traffic Trends

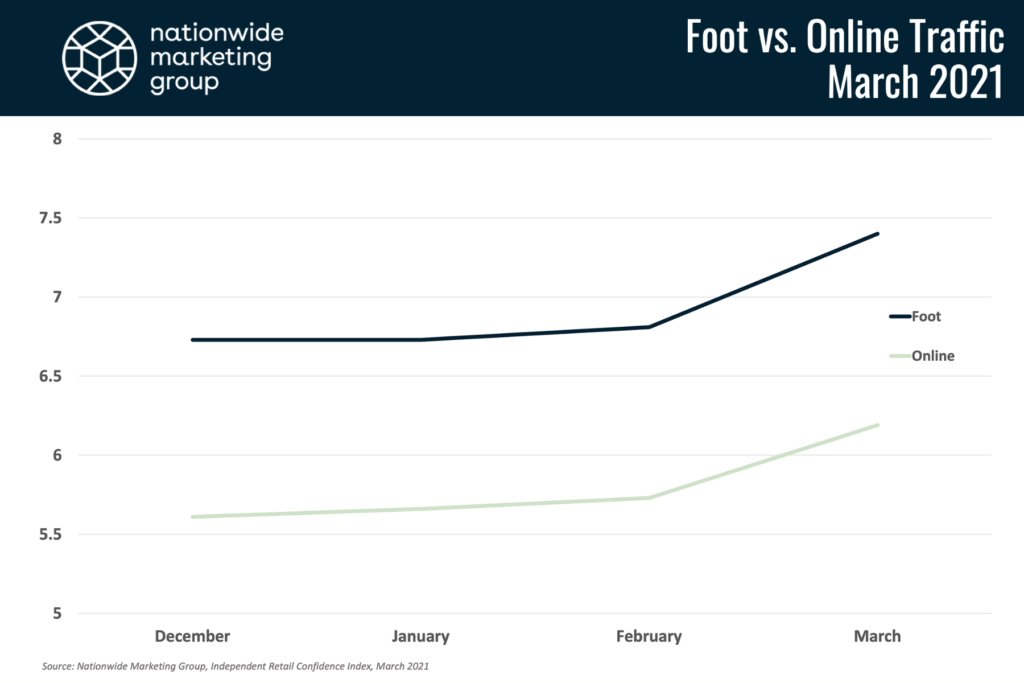

To that end, foot and online traffic had their strongest months on record in the March NMG Index survey. Both metrics saw roughly half-point gains over the previous month.

On the foot traffic side, the rebound can almost be directly attributed to the rollout of the COVID-19 vaccine across the country. The March NMG Index survey wrapped just as the FDA and CDC both signed off on the Johnson & Johnson vaccine — the third approved COVID-fighting shot to be approved for distribution in the U.S.

And on the online side, more retailers in this survey reported making efforts to turn on the ecommerce functionality of their websites than in previous surveys. It’s been regularly noted on the Nationwide Marketing Group blog how much on an impact this pandemic has had on consumer shopping behaviors — particularly online. Younger consumers were already very comfortable with the idea of shopping online. Now, thanks to the pandemic, that trend has completely broken down the cross-generational barriers and become a regular way of shopping.

Product Confidence vs. Store-Type Confidence

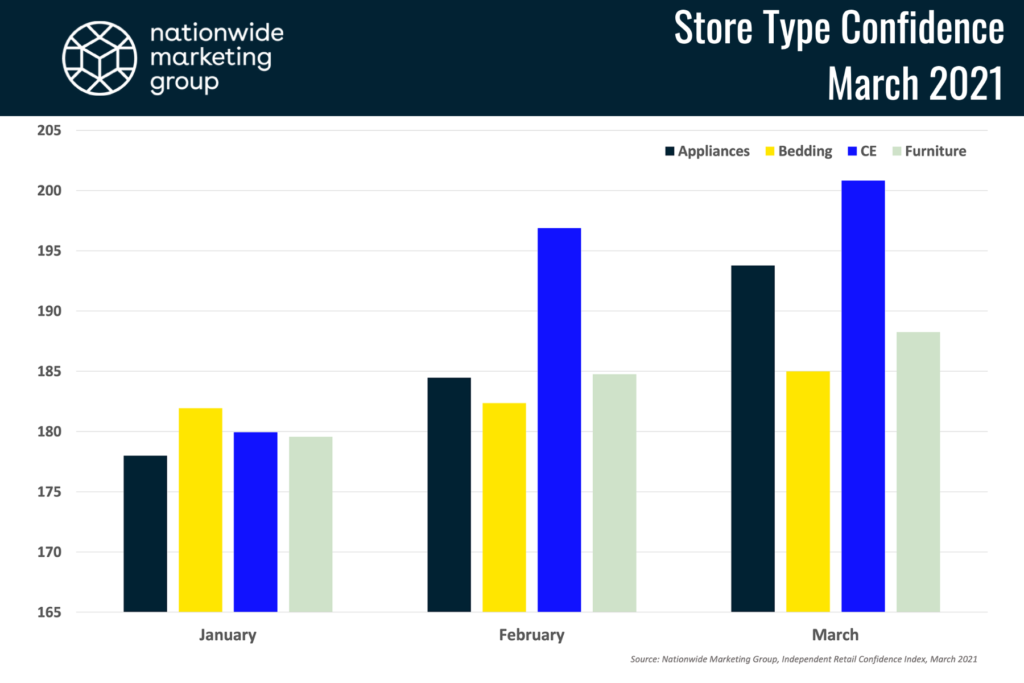

An interesting correlation popped up in the March NMG Index report. We’ve often looked at the store-types (Appliance vs. Bedding vs. CE vs. Furniture) in a vacuum alongside the overall confidence. What may make more sense, moving forward is placing this category next to the individual product types and their confidence levels.

With the jump in overall confidence in March, it’s no shock that the individual store types also saw their confidence levels increase, but diving deeper into the products themselves sheds a little more insight on the varying degrees of confidence across those store types.

Consumer Electronics retailers continued their run as the most-confident store type across the Independent channel. But the biggest month-over-month jump in confidence was seen by Appliance dealers. The category checked in at 193.78 in March, a category-high and up nearly 10 points from February’s survey.

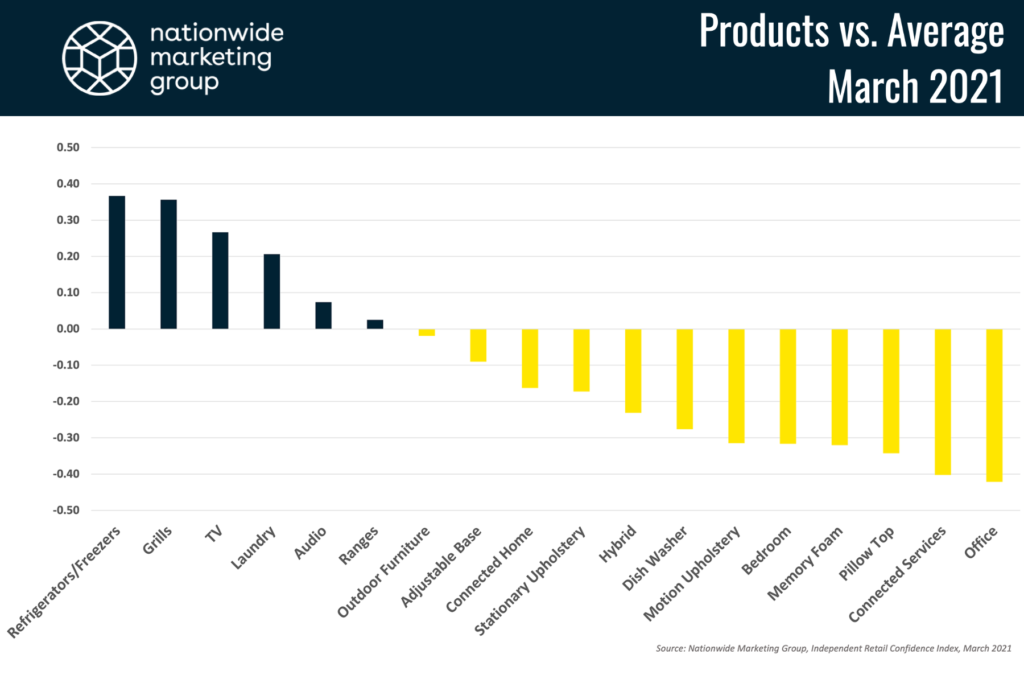

A quick check of the March product confidence scores vs. their lifetime survey averages shows how this happened. Four of the five appliance categories that the NMG Index surveys for were up over their overall average.

One interesting note from the product chart above — Office Furniture had the widest gap between its March score compared to its overall average. That seems to conflict with just how strong the category has performed among the broader retail landscape and with how in-demand home office furniture continues to be. That would seem to suggest retailers are struggling to get the supply they need in the Office Furniture category to meet that demand.

Sales Spark

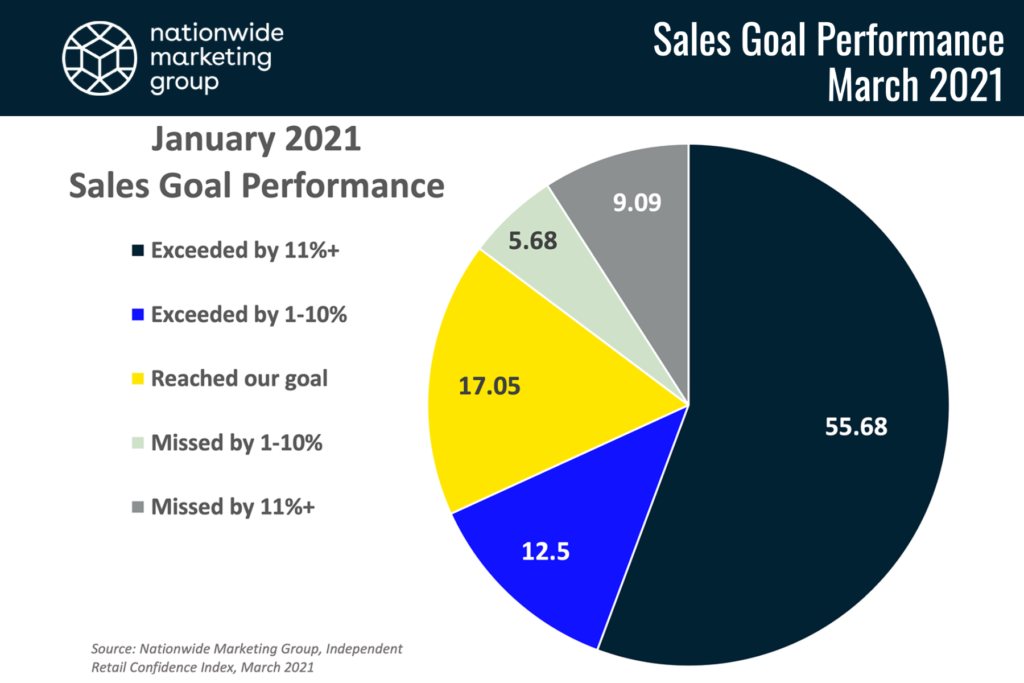

January sales goal performance was among the strongest the NMG Index has seen and certainly the strongest in recent months.

In January 55.7% of responding retailers reported exceeding their sales goal by more than 11%, up nearly 13% from the previous month. Combined, 85% of retailers reported exceeding or hitting their sales goals for January, which was a big improvement from the 75% who did the same in December.

The second round of COVID stimulus check payments from the U.S. government began hitting bank accounts in early January.